Question: Management Accounting 3 ( Module 2 ) Year - end SUPP. Examination 2 0 1 3 Question 2 Novak Industries ( Pty ) Ltd is

Management Accounting Module Yearend SUPP. Examination

Question

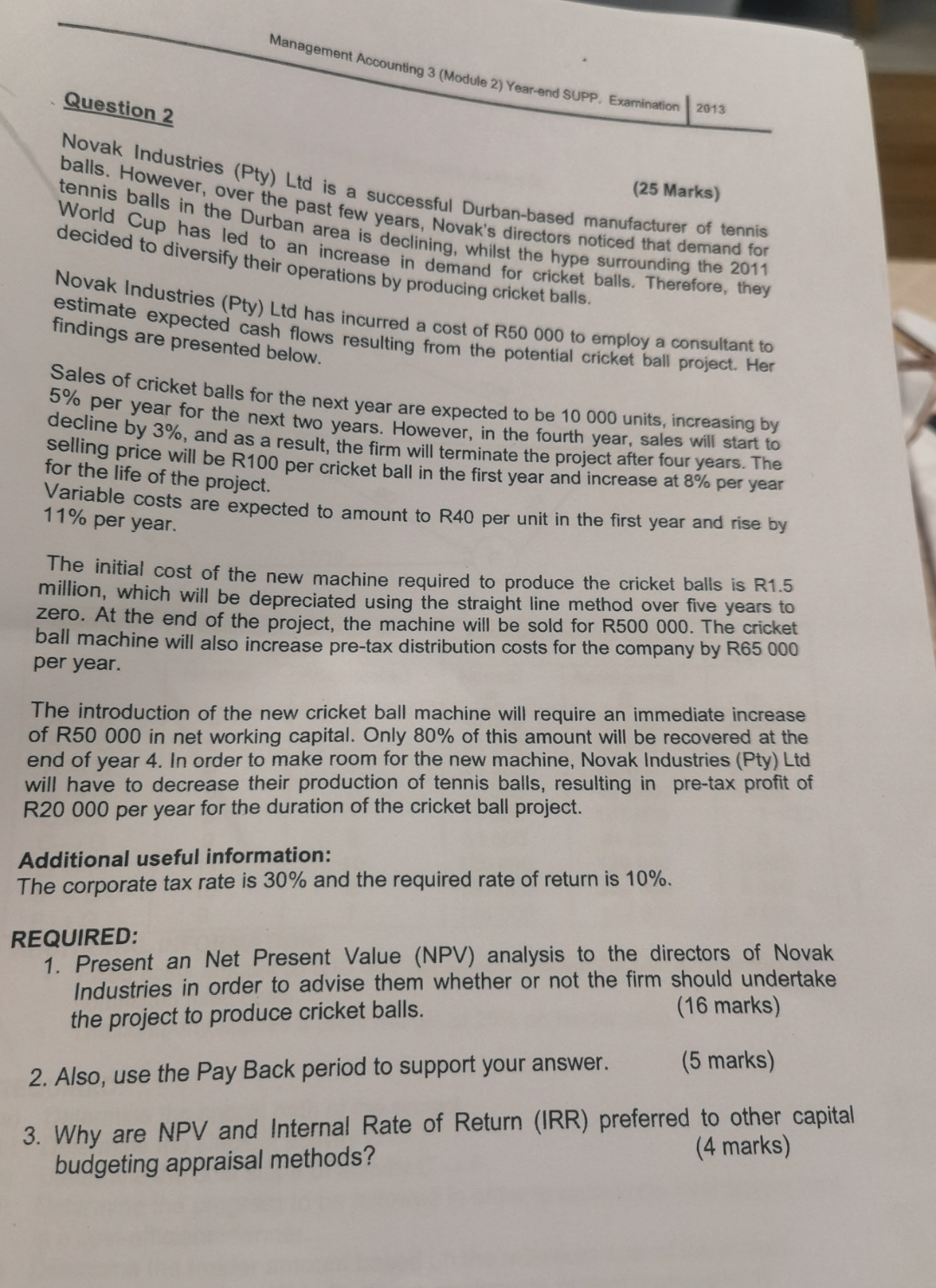

Novak Industries Pty Ltd is a successful Durbanbased manufacturer of tennis

Marks balls. However, over the past few years, Novak's directors noticed that demand for tennis balls in the Durban area is declining, whilst the hype surrounding the operations by producing cricket balls. balls. Therefore, they

Novak Industries Pty Ltd has incurred a cost of R to employ a consultant to estimate expected cash flows resulting from the potential cricket ball project. Her findings are presented below.

Sales of cricket balls for the next year are expected to be units, increasing by per year for the next two years. However, in the fourth year, sales will start to decline by and as a result, the firm will terminate the project after four years. The selling price will be R per cricket ball in the first year and increase at per year for the life of the project.

Variable costs are expected to amount to R per unit in the first year and rise by per year.

The initial cost of the new machine required to produce the cricket balls is R million, which will be depreciated using the straight line method over five years to zero. At the end of the project, the machine will be sold for R The cricket ball machine will also increase pretax distribution costs for the company by R per year.

The introduction of the new cricket ball machine will require an immediate increase of R in net working capital. Only of this amount will be recovered at the end of year In order to make room for the new machine, Novak Industries Pty Ltd will have to decrease their production of tennis balls, resulting in pretax profit of R per year for the duration of the cricket ball project.

Additional useful information:

The corporate tax rate is and the required rate of return is

REQUIRED:

Present an Net Present Value NPV analysis to the directors of Novak Industries in order to advise them whether or not the firm should undertake the project to produce cricket balls.

marks

Also, use the Pay Back period to support your answer.

marks

Why are NPV and Internal Rate of Return IRR preferred to other capital budgeting appraisal methods?

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock