Question: Management Accounting Just Answer Number 2 (prepare journal entry) it is already clear, the picture already clear enough what do you mean by it is

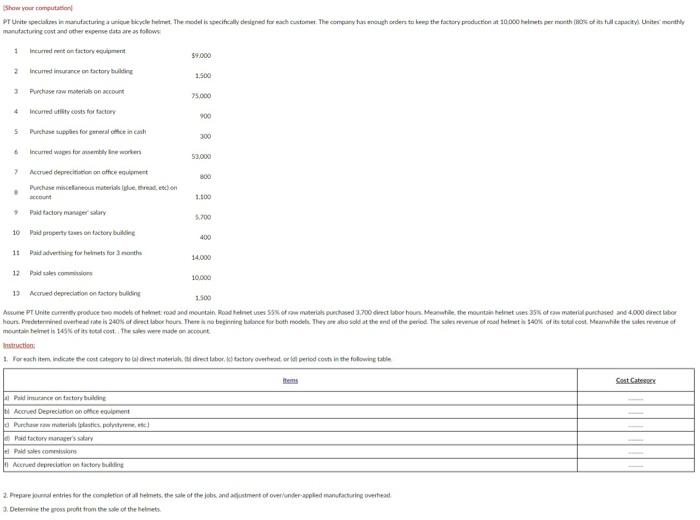

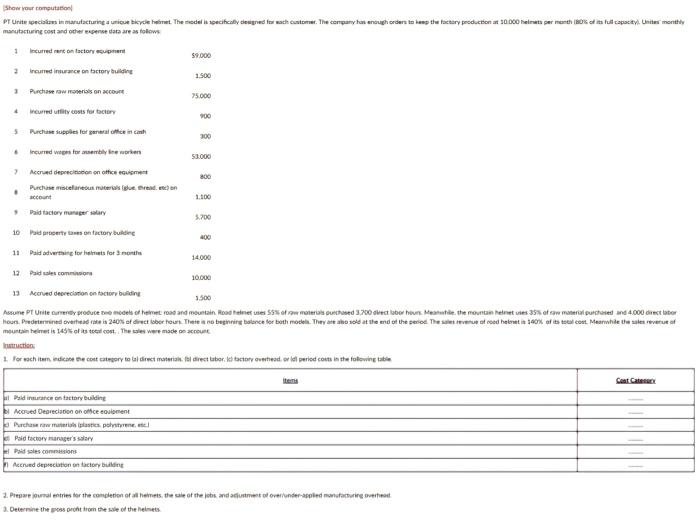

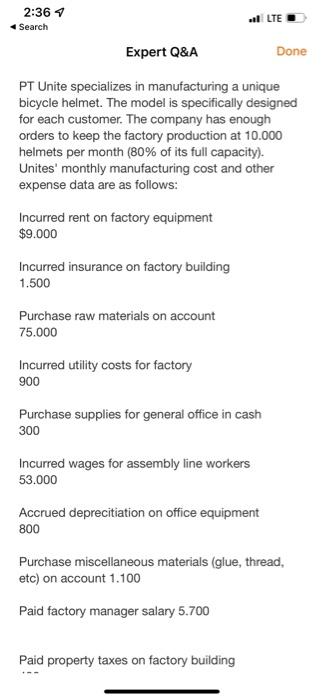

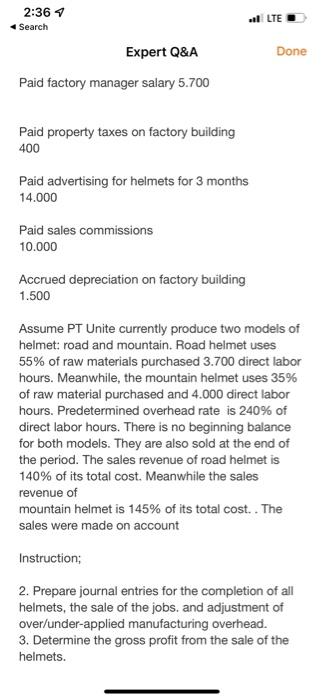

Show your computation PT Unite specializes in manufacturing a unique bicycle helmet. The model is specifically designed for each customer. The company has enough orders to keep the factory production at 10.000 helmets per month (80% of its full capacity) Unites monthly manufacturing cost and other expense data are as follows 1 incurred net on factory equipment 2 incurred insurance on factory building 3 Purchase raw materials on account 4 lncurred utility costs for factory 5 Purchase supplies for general office in cash incurred wages for asembly line workers 7 Accrued depreciation on office equipment Purchase miscellaneous materials (ue, thread, etc) on account Paid factory manager salary $9.000 Paid insurance on factory building Accrued Depreciation on office equipment Purchase raw materials (plastics, polystyrene, etc) Paid factory manager's salary 1,500 el Paid sales commissions Accrued depreciation on factory building 75,000 900 300 53.000 800 1.100 10 Paid property taxes on factory building 11 Paid advertising for helmets for 3 months 12 Paid sales commissions 10,000 1.500 13 Accrued depreciation on factory building Assume PT Unite currently produce two models of helmet road and mountain Road helnet uses 55% of raw materials purchased 3.700 direct labor hours. Meanwhile, the mountain helnet uses 35% of raw material purchased and 4.000 direct labor hours. Predetermined overhead rate is 240% of direct labor hours. There is no beginning balance for both models. They are also sold at the end of the period. The sales revenue of road helmet is 140% of its total cost. Meanwhile the sales revenue of mountain helmet is 145% of its total cost. The sales were made on account 5,700 400 Instruction 1. For each item, indicate the cost category to al direct materiah, tbl direct labor, id factory overheat, or id period costs in the following table 14.000 2. Prepare journal entries for the completion of all helmets, the sale of the jobs, and adjustment of over/under-applied manufacturing overhead 3. Determine the gross pront from the sale of the helmets Cost Cate Show your computation PT Unite specializes in manufacturing a unique bicycle helmet. The model is specifically designed for each customer. The company has enough orders to keep the factory production at 10.000 helmets per month (80% of its full capacity. Unites monthly manufacturing cost and other expense data are as follows 1 incurred rent on factory equipment 2 incurred insurance on factory building 1 Purchase raw materials on account 4 incurred utility costs for factory 5 Purchase supplies for general office in cash & incurred wages for sembly in workers 7 Accrued depreciation on office equipment Purchase miscellaneous materials (glue thread, etc) on . Paid factory manager salary 10 Paid property taxes on factory building 11 Paid advertising for helmets for 3 months $9.000 1.500 al Paid insurance on factory building Accrued Depreciation on office equipment Purchase raw materials (plastics, polystyrene Paid factory manager's salary Paid sales commissions Accrued depreciation on factory building 75.000 900 300 53.000 800 1.100 5.700 400 14.000 12 Paid sales commission 10.000 1.500 13 Accrued depreciation on factory building Assume PT Unite currently produce two models of helmet road and mountain Road helmet uses 55% of raw materials purchased 3.700 direct labor hours. Meanwhile, the mountain helnet uses 35% of raw material purchased and 4.000 direct labor hours. Predetermined overhead rate is 240% of direct lobor hours. There is no beginning balance for both models. They are also sold at the end of the period. The sales revenue of road helmet is 140% of its total cost. Meanwhile the sales revenue of mountain helmet is 145% of its total cost. The sales were made on account Instruction 1. For each item, indicate the cost category to al direct materials. fol direct labor, id factory overhead, orld period costs in the following table 2. Prepare journal entries for the completion of all helmets, the sale of the jobs and adjustment of over/under-applied manufacturing overhead 3. Determine the gross proht from the sale of the helmets Cent Cate 2:36 Search Incurred rent on factory equipment $9.000 Expert Q&A PT Unite specializes in manufacturing a unique bicycle helmet. The model is specifically designed for each customer. The company has enough orders to keep the factory production at 10.000 helmets per month (80% of its full capacity). Unites' monthly manufacturing cost and other expense data are as follows: Incurred insurance on factory building 1.500 Purchase raw materials on account 75.000 Incurred utility costs for factory 900 Purchase supplies for general office in cash 300 Incurred wages for assembly line workers 53.000 Accrued deprecitiation on office equipment 800 LTE Done Paid property taxes on factory building Purchase miscellaneous materials (glue, thread, etc) on account 1.100 Paid factory manager salary 5.700 2:36 4 Search Expert Q&A Paid factory manager salary 5.700 Paid property taxes on factory building 400 Paid advertising for helmets for 3 months 14.000 Paid sales commissions 10.000 allLTE Accrued depreciation on factory building 1.500 Done Assume PT Unite currently produce two models of helmet: road and mountain. Road helmet uses 55% of raw materials purchased 3.700 direct labor hours. Meanwhile, the mountain helmet uses 35% of raw material purchased and 4.000 direct labor hours. Predetermined overhead rate is 240% of direct labor hours. There is no beginning balance for both models. They are also sold at the end of the period. The sales revenue of road helmet is 140% of its total cost. Meanwhile the sales revenue of mountain helmet is 145% of its total cost.. The sales were made on account Instruction; 2. Prepare journal entries for the completion of all helmets, the sale of the jobs. and adjustment of over/under-applied manufacturing overhead. 3. Determine the gross profit from the sale of the helmets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts