Question: Management Accounting: Please help and show the computations will definitely up vote The wireless phone manufacturing division of a Cyberjaya-based consumer electronics company uses activity-based

Management Accounting:

Please help and show the computations will definitely up vote

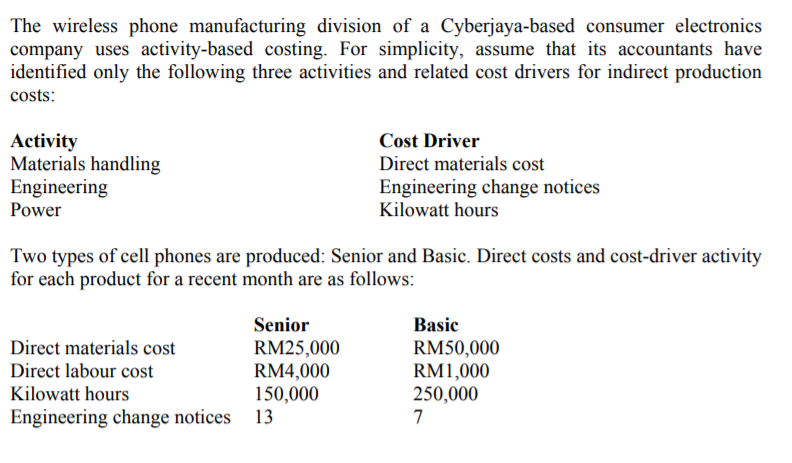

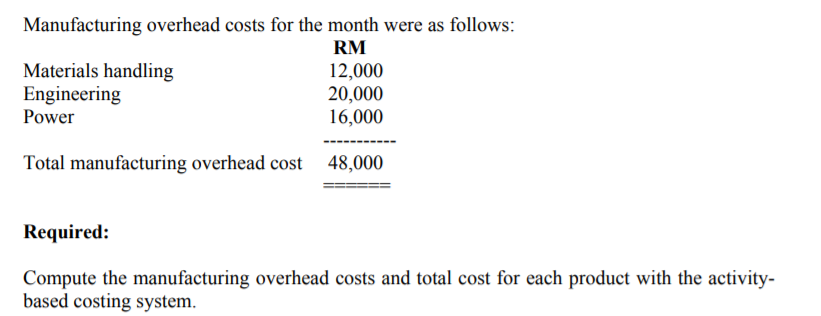

The wireless phone manufacturing division of a Cyberjaya-based consumer electronics company uses activity-based costing. For simplicity, assume that its accountants have identified only the following three activities and related cost drivers for indirect production costs: Activity Materials handling Engineering Power Cost Driver Direct materials cost Engineering change notices Kilowatt hours Two types of cell phones are produced: Senior and Basic. Direct costs and cost-driver activity for each product for a recent month are as follows: Direct materials cost Direct labour cost Kilowatt hours Engineering change notices Senior RM25,000 RM4,000 150,000 Basic RM50,000 RM1,000 250,000 7 Manufacturing overhead costs for the month were as follows: RM Materials handling 12,000 Engineering 20,000 Power 16,000 Total manufacturing overhead cost 48,000 Required: Compute the manufacturing overhead costs and total cost for each product with the activity- based costing system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts