Question: management PROBLEM 4-14 Analysis of Work In Process T-account-Weighted-Average Method LO4-1, LO4-2. LO4-3, LO4-4 Weston Products manufactures an industrial cleaning compound that goes through three

management

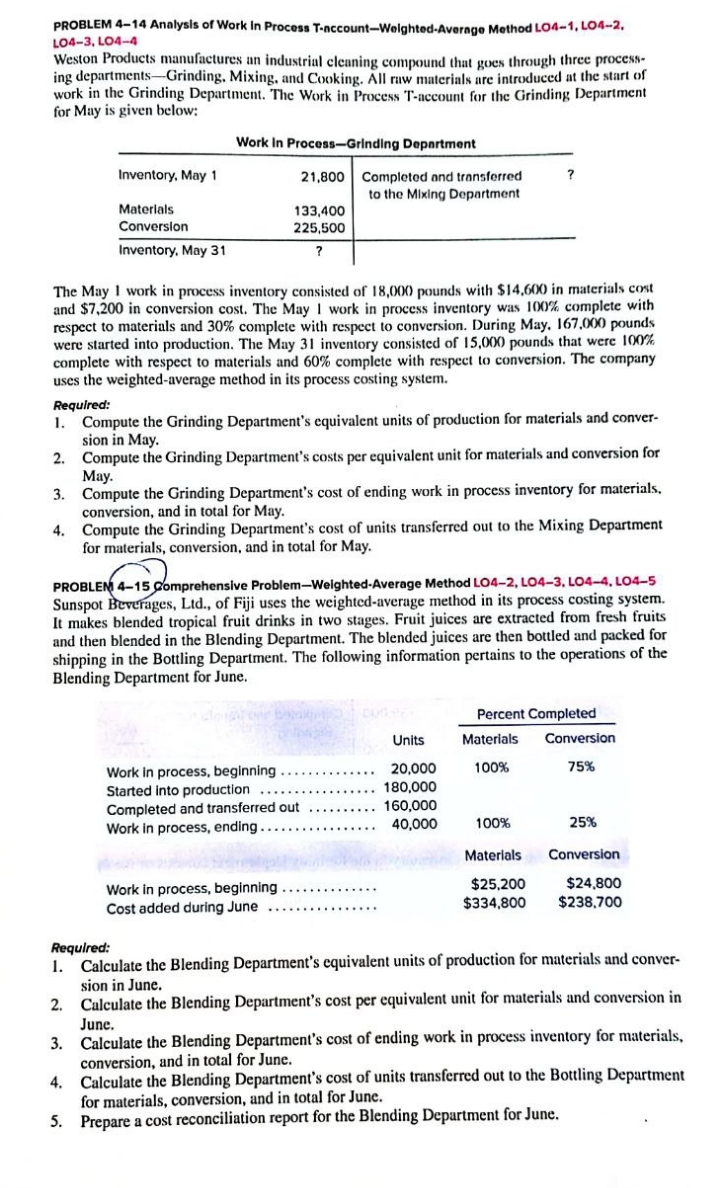

PROBLEM 4-14 Analysis of Work In Process T-account-Weighted-Average Method LO4-1, LO4-2. LO4-3, LO4-4 Weston Products manufactures an industrial cleaning compound that goes through three process- ing departments-Grinding. Mixing, and Cooking. All raw materials are introduced at the start of work in the Grinding Department. The Work in Process T-account for the Grinding Department for May is given below: Work In Process-Grinding Department Inventory. May 1 21.800 Completed and transferred to the Mixing Department Materials 133,400 Conversion 225,500 Inventory, May 31 The May I work in process inventory consisted of 18,000 pounds with $14,600 in materials cost and $7,200 in conversion cost. The May I work in process inventory was 100% complete with respect to materials and 30% complete with respect to conversion. During May. 167,000 pounds were started into production. The May 31 inventory consisted of 15,000 pounds that were 100% complete with respect to materials and 60% complete with respect to conversion. The company uses the weighted-average method in its process costing system. Required: 1. Compute the Grinding Department's equivalent units of production for materials and conver- sion in May. 2. Compute the Grinding Department's costs per equivalent unit for materials and conversion for May. 3. Compute the Grinding Department's cost of ending work in process inventory for materials. conversion, and in total for May. 4. Compute the Grinding Department's cost of units transferred out to the Mixing Department for materials, conversion, and in total for May. PROBLEM 4-15 Comprehensive Problem-Weighted-Average Method LO4-2, LO4-3, LO4-4, LO4-5 Sunspot Beverages, Lid., of Fiji uses the weighted-average method in its process costing system. It makes blended tropical fruit drinks in two stages. Fruit juices are extracted from fresh fruits and then blended in the Blending Department. The blended juices are then bottled and packed for shipping in the Bottling Department. The following information pertains to the operations of the Blending Department for June. Percent Completed Units Materials Conversion Work in process, beginning ..... . . . . . 20,000 100% 75% Started into production 180,000 Completed and transferred out . . ........ 160,000 Work in process, ending ... 40,000 100% 25% Materials Conversion Work in process, beginning .. $25.200 $24.800 Cost added during June $334,800 $238,700 Required: 1. Calculate the Blending Department's equivalent units of production for materials and conver- sion in June. 2. Calculate the Blending Department's cost per equivalent unit for materials and conversion in June. 3. Calculate the Blending Department's cost of ending work in process inventory for materials, conversion, and in total for June. 4. Calculate the Blending Department's cost of units transferred out to the Bottling Department for materials, conversion, and in total for June. 5. Prepare a cost reconciliation report for the Blending Department for June

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts