Question: Management provides the current balance sheet below. In planning for next year they are making the following assumptions Sales will increase by 25% Net income

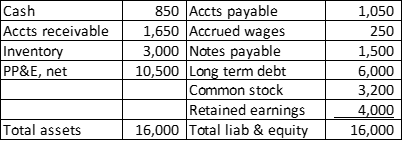

Management provides the current balance sheet below. In planning for next year they are making the following assumptions

Sales will increase by 25%

Net income is projected to be $1,470

The plan will require an addition to PPE of $2,000

The firm pays a dividend 30%

Calculate the amount of additional funds needed.

$2,021

$1,601

$3,290

$1,580

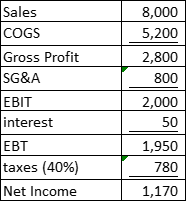

Management provides the current income statement below. In planning for next year they are making the following assumptions:

Sales will increase by 15%

They will pay a 20% dividend

Calculate the forecasted change in Retained Earnings

Select one:

$1,350

$1,080

$936

$1,076

Cash 850 Accts payable Accts receivable1,650 Accrued wages 3,000 Notes payable 1,050 250 1,500 6,000 3,200 4,000 Total assets 16,000 Total liab& equity16,000 Accts receivable1,650 nventory PP&E, net 10,500 Long term debt Common stock Retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts