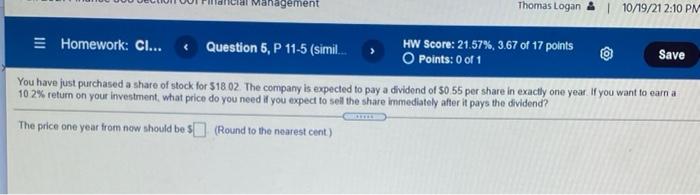

Question: Management Thomas Logan & 10/19/212:10 PM > Homework: CI... Question 5, P 11-5 (simil.... HW Score: 21.57%, 3.67 of 17 points Save O Points: 0

Management Thomas Logan & 10/19/212:10 PM > Homework: CI... Question 5, P 11-5 (simil.... HW Score: 21.57%, 3.67 of 17 points Save O Points: 0 of 1 You have just purchased a share of stock for $18.02. The company is expected to pay a dividend of 50 55 per share in exactly one year. If you want to earn a 102% return on your investment, what price do you need if you expect to sell the share immediately after it pays the dividend? The price one year from now should be $ (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts