Question: managerial account case study. need help figuring it out please. Inculded the case study from the book the professor included Molding Fabricat ion Estimated total

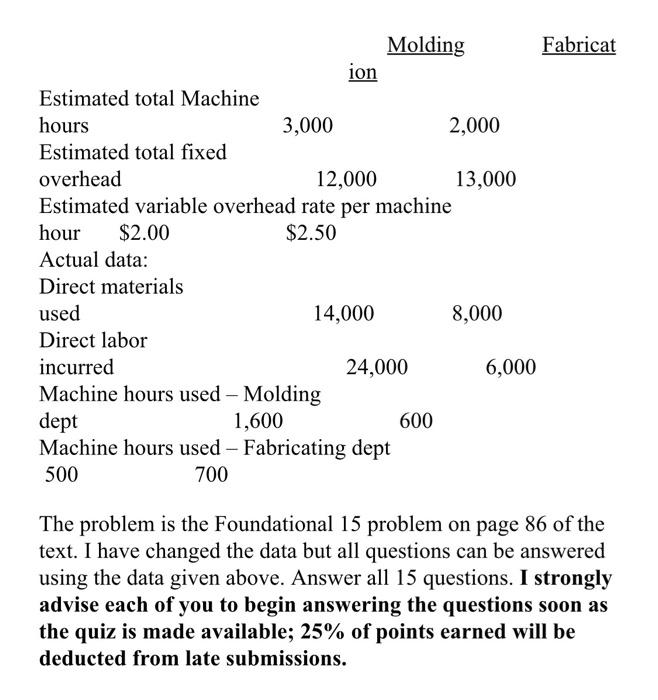

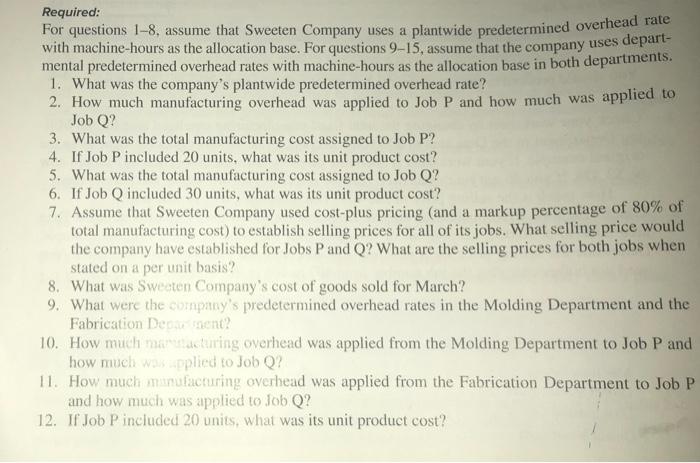

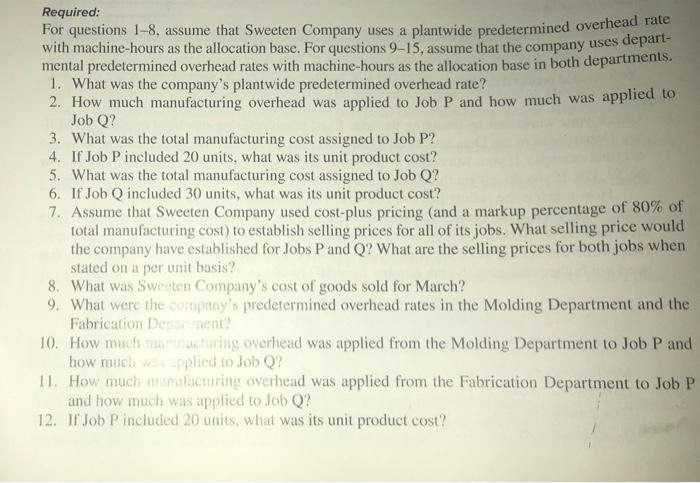

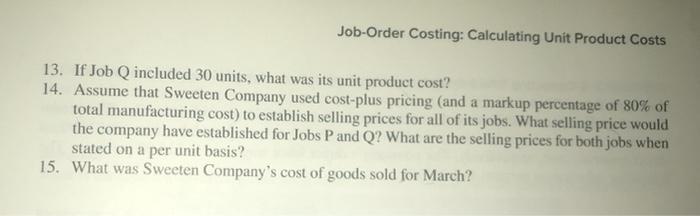

Molding Fabricat ion Estimated total Machine hours 3,000 2,000 Estimated total fixed overhead 12,000 13,000 Estimated variable overhead rate per machine hour $2.00 $2.50 Actual data: Direct materials used 14,000 8,000 Direct labor incurred 24,000 6,000 Machine hours used - Molding dept 1,600 600 Machine hours used - Fabricating dept 500 700 The problem is the Foundational 15 problem on page 86 of the text. I have changed the data but all questions can be answered using the data given above. Answer all 15 questions. I strongly advise each of you to begin answering the questions soon as the quiz is made available; 25% of points earned will be deducted from late submissions. Required: with machine-hours as the allocation base. For questions 9-15, assume that the company uses depart- For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate mental predetermined overhead rates with machine-hours as the allocation base in both departments. 1. What was the company's plantwide predetermined overhead rate? 2. How much manufacturing overhead was applied to Job P and how much was applied to Job Q? 3. What was the total manufacturing cost assigned to Job P? 4. If Job P included 20 units, what was its unit product cost? 5. What was the total manufacturing cost assigned to Job Q? 6. If Job included 30 units, what was its unit product cost? 7. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? 8. What was Swearen Company's cost of goods sold for March? 9. What were the company's predetermined overhead rates in the Molding Department and the Fabrication Degere sent? 10. How much matering overhead was applied from the Molding Department to Job P and how much was applied to Job Q? 11. How much mufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job Q? 12. If Job P included 20 units, what was its unit product cost? Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses depart- mental predetermined overhead rates with machine-hours as the allocation base in both departments. 1. What was the company's plantwide predetermined overhead rate? 2. How much manufacturing overhead was applied to Job P and how much was applied to Job Q? 3. What was the total manufacturing cost assigned to Job P? 4. If Job P included 20 units, what was its unit product cost? 5. What was the total manufacturing cost assigned to Job Q? 6. If Job Q included 30 units, what was its unit product cost? 7. Assume that Sweeten Company used cost-plus pricing and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? 8. What was Sweden Company's cost of goods sold for March? 9. What were the company's predetermined overhead rates in the Molding Department and the Fabrication Des ent? 10. How much mal during overhead was applied from the Molding Department to Job P and how much weapplied to Job Q? 11. How much tufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job Q? 12. If Job P included 20 units, what was its unit product cost? Job-Order Costing: Calculating Unit Product Costs 13. If Job Q included 30 units, what was its unit product cost? 14. Assume that Sweeten Company used cost-plus pricing and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? 15. What was Sweeten Company's cost of goods sold for March? Molding Fabricat ion Estimated total Machine hours 3,000 2,000 Estimated total fixed overhead 12,000 13,000 Estimated variable overhead rate per machine hour $2.00 $2.50 Actual data: Direct materials used 14,000 8,000 Direct labor incurred 24,000 6,000 Machine hours used - Molding dept 1,600 600 Machine hours used - Fabricating dept 500 700 The problem is the Foundational 15 problem on page 86 of the text. I have changed the data but all questions can be answered using the data given above. Answer all 15 questions. I strongly advise each of you to begin answering the questions soon as the quiz is made available; 25% of points earned will be deducted from late submissions. Required: with machine-hours as the allocation base. For questions 9-15, assume that the company uses depart- For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate mental predetermined overhead rates with machine-hours as the allocation base in both departments. 1. What was the company's plantwide predetermined overhead rate? 2. How much manufacturing overhead was applied to Job P and how much was applied to Job Q? 3. What was the total manufacturing cost assigned to Job P? 4. If Job P included 20 units, what was its unit product cost? 5. What was the total manufacturing cost assigned to Job Q? 6. If Job included 30 units, what was its unit product cost? 7. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? 8. What was Swearen Company's cost of goods sold for March? 9. What were the company's predetermined overhead rates in the Molding Department and the Fabrication Degere sent? 10. How much matering overhead was applied from the Molding Department to Job P and how much was applied to Job Q? 11. How much mufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job Q? 12. If Job P included 20 units, what was its unit product cost? Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses depart- mental predetermined overhead rates with machine-hours as the allocation base in both departments. 1. What was the company's plantwide predetermined overhead rate? 2. How much manufacturing overhead was applied to Job P and how much was applied to Job Q? 3. What was the total manufacturing cost assigned to Job P? 4. If Job P included 20 units, what was its unit product cost? 5. What was the total manufacturing cost assigned to Job Q? 6. If Job Q included 30 units, what was its unit product cost? 7. Assume that Sweeten Company used cost-plus pricing and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? 8. What was Sweden Company's cost of goods sold for March? 9. What were the company's predetermined overhead rates in the Molding Department and the Fabrication Des ent? 10. How much mal during overhead was applied from the Molding Department to Job P and how much weapplied to Job Q? 11. How much tufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job Q? 12. If Job P included 20 units, what was its unit product cost? Job-Order Costing: Calculating Unit Product Costs 13. If Job Q included 30 units, what was its unit product cost? 14. Assume that Sweeten Company used cost-plus pricing and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? 15. What was Sweeten Company's cost of goods sold for March

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts