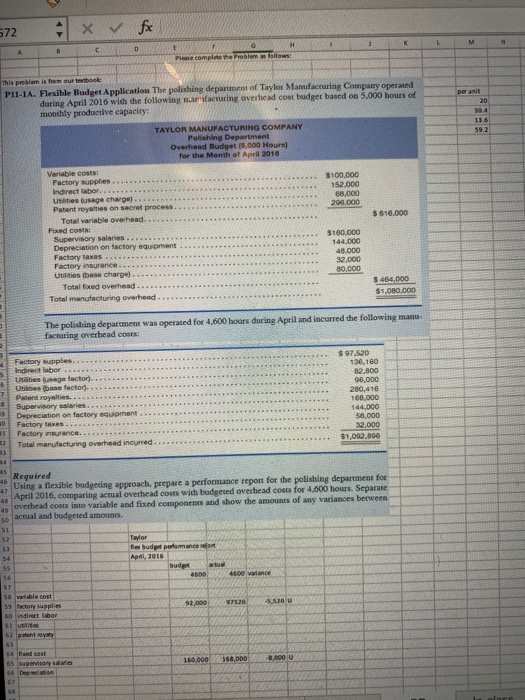

Question: managerial accounting chapter 11 172 x fx C This problem is from our lobook P11-1A. Flexible Budget Application The polishing depart of Taylor Manufacturing Company

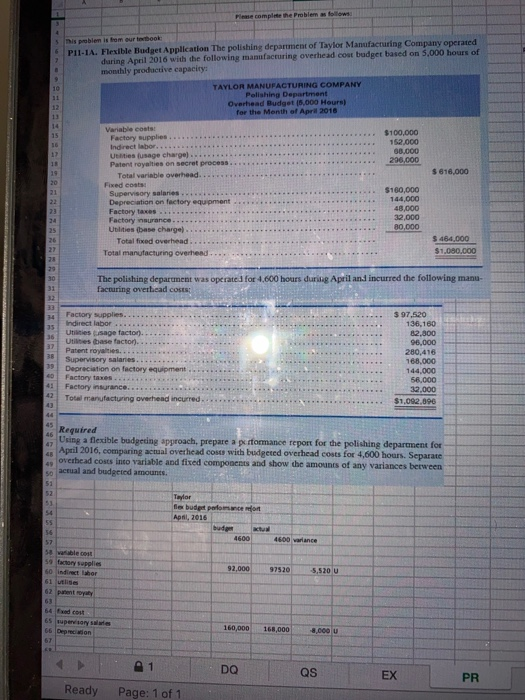

172 x fx C This problem is from our lobook P11-1A. Flexible Budget Application The polishing depart of Taylor Manufacturing Company operated during April 2016 with the following m a turing overhead cost budget based on 5.000 hours of monthly productive capacity: TAYLOR MANUFACTURING COMPANY Polishing Department Overhead Budget (5,000 Hours for the Month of April 2016 Variable costs $100.000 152000 68,000 200.000 $ 610.000 $160.000 Indirect labor. Uites usage charge... Patentoyees on secret process Total variable overhead. Foxed cost Supervisory salaries ......... Depreciation on factory equipment Factory taxes Factory insurance..... Utilities base charge).... Totalfixed overhead. Total manufacturing overhead 80.000 $ 464,000 The polishing department was operated for 4,600 hours during April and incurred the following manu- facturing overhead coses Factory supplies. ** ** 136,160 U 90.000 200,416 s age factor). ....... Utilities as factor), Patent royalties Supervisory res... Depreciation on factory equipment Factory taxes. Factory insurance.. . Total menacturing overhead incurred. 51.002. Required Using a flexible budgeting approach. prepare a performance report for the polishing department for April 2016, comparing actual overhead con with budged overhead costs for 4.000 hours Separate Overhead costs into variable and fixed components and show the amounts of any variances between actual and budged amounts 5 6 is problem is from our book PHIA Flexible Budget Application The polishing department of Taylor Manufacturing Company operated during April 2016 with the following manufacturing overhead cost budget based on 5,000 hours of monthly productive capacity: TAYLOR MANUFACTURING COMPANY Polishing Department Overhead Budget 10.000 Hours) for the Month of April 2016 $100,000 00.000 290.000 $ 616,000 Variable costs! Factory supplies.. Indirect labor.. . Uites usage charge) . Patent royalties on secret process Total variable overhead... Fixed costs Supervisory salaries. Depreciation on factory equipment Factory taxes.... Factory insurance..... Utilities base charge) Total fixed overhead... Total manufacturing overhead. $100,000 144,000 48,000 32.000 80,000 $ 464,000 $1.080.000 The polishing department was operated for 4,600 hours during April an incurred the following mana facturing overhead costs Factory supplies.. Indirect labor.. Utilities isage factor)... Utilities as facton.. Patent royalties... Supervisory salaries.......... Depreciation on factory equipment Factory taxes Factory insurance Total manufacturing overhead incurred... $ 97,520 136,160 82.300 96,000 280.416 168,000 144.000 50.000 32.000 $1.092.390 Required Using a flexible budgeting approach, prepare a performance report for the polishing department for April 2016, comparing actual overhead costs with budgeted overhead costs for 4,600 hours. Separate overhead costs into variable and fixed components and show the amounts of any variances between actual and budgeted amounts Taylor budet performance April, 2016 92,000 97520 1 DQ QSFX EX PR Ready Page: 1 of 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts