Question: Managerial Accounting Help . Below is a 4 part question - I am getting the answers to the first three parts, but the 4th part

Managerial Accounting Help. Below is a 4 part question - I am getting the answers to the first three parts, but the 4th part escapes me. Thank you in advance.

PART 4 of 4

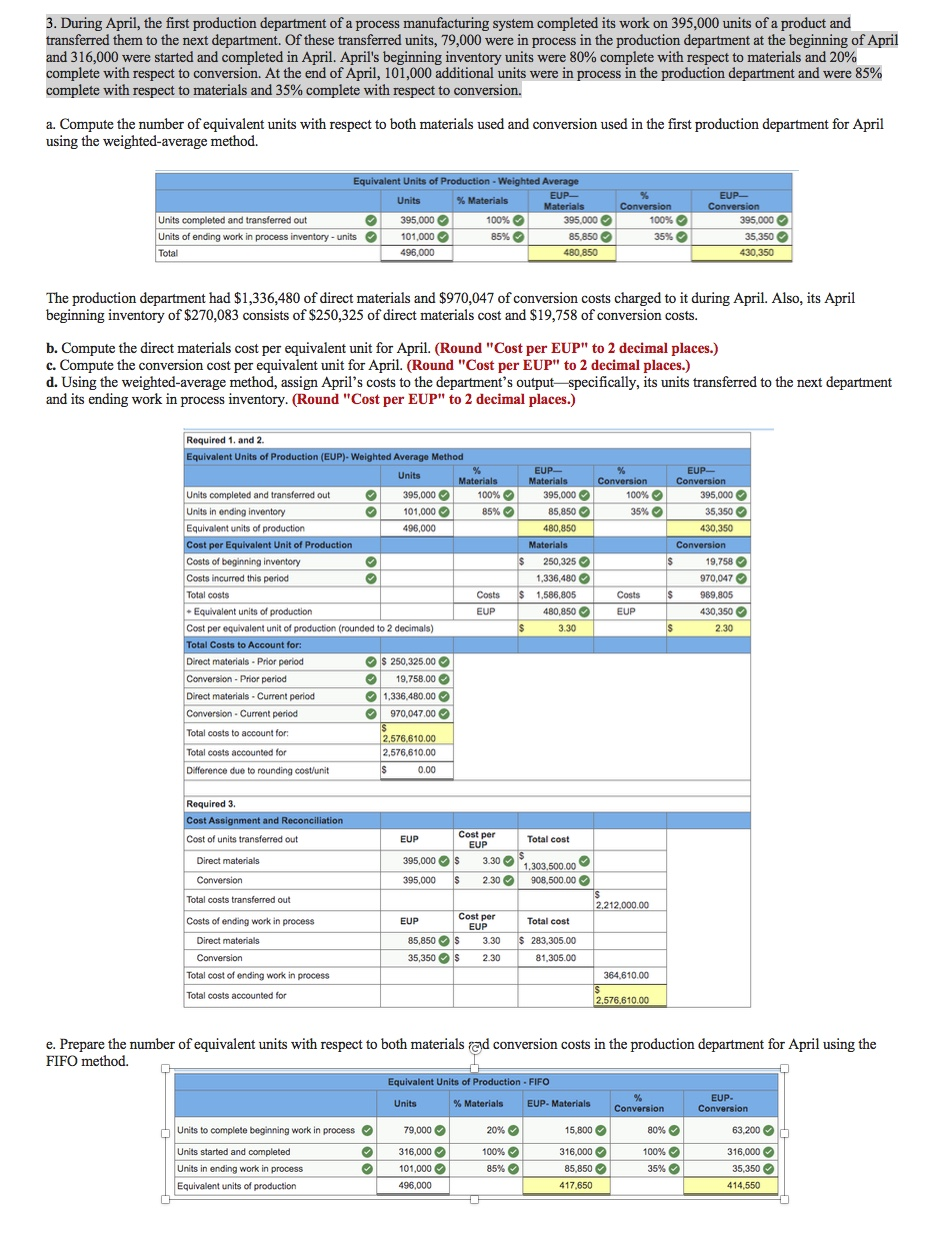

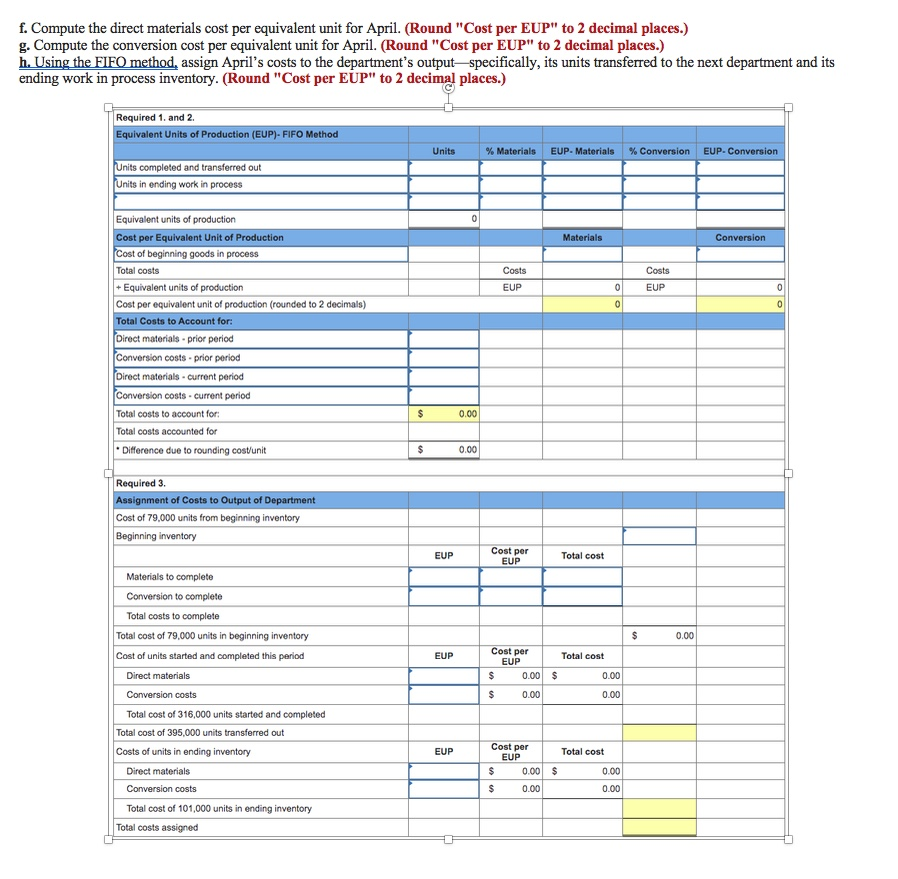

3. During April, the first production department of a process manufacturing system completed its work on 395,000 units of a product and transferred them to the next department. Of these transferred units, 79,000 were in process in the production department at the beginning of April and 316,000 were started and completed in April. April's beginning inventory units were 80% complete with respect to materials and 20% complete with respect to conversion. At the end of April, 101,000 additional units were in process in the production department and were 85% complete with respect to materials and 35% complete with respect to conversion a. Compute the number of equivalent units with respect to both materials used and conversion used in the first production department for April using the weighted average method. Equivalent Units of Production - Weighted Average Units % Materials EUP Materials Units completed and transferred out 395,000 100% 395,000 Units of ending work in process inventory - units 101,000 85% 85,850 Total 496,000 480,850 Conversion 100% 35% EUP Conversion 395,000 35,350 430,350 The production department had $1,336,480 of direct materials and $970,047 of conversion costs charged to it during April. Also, its April beginning inventory of $270,083 consists of $250,325 of direct materials cost and $19,758 of conversion costs. b. Compute the direct materials cost per equivalent unit for April. (Round "Cost per EUP" to 2 decimal places.) c. Compute the conversion cost per equivalent unit for April. (Round "Cost per EUP" to 2 decimal places.) d. Using the weighted-average method, assign April's costs to the department's output-specifically, its units transferred to the next department and its ending work in process inventory. (Round "Cost per EUP" to 2 decimal places.) % Conversion 100% 35% 85% EUP- Materials 395,000 85,850 480,850 Materials $ 250,325 1,336,480 $ 1,586,805 480,850 $ 3.30 EUP Conversion 395,000 35,350 430,350 Conversion 19,758 970,047 989.805 430,350 $ Required 1 and 2 Equivalent Units of Production (EUP)-Weighted Average Method Units Materials Units completed and transferred out 395,000 100% Units in ending inventory 101,000 Equivalent units of production 496,000 Cost per Equivalent Unit of Production Costs of beginning inventory Costs incurred this period Total costs Costs Equivalent units of production EUP Cost per equivalent unit of production (rounded to 2 decimals) Total Costs to Account for: Direct materials - Prior period $ 250,325.00 Conversion - Prior period 19,758.00 Direct materials - Current period 1,336,480.00 Conversion - Current period 970,047.00 Total costs to account for: $ 2.576,610.00 Total costs accounted for 2,576,610.00 Difference due to rounding cost/unit S 0.00 Costs $ EUP $ 2.30 Cost per EUP EUP 3.30 395,000 $ 395,000 s Total cost $ 1,303,500.00 908,500.00 2.30 Required 3. Cost Assignment and Reconciliation Cost of units transferred out Direct materials Conversion Total costs transferred out Costs of ending work in process Direct materials Conversion Total cost of ending work in process Total costs accounted for s 2.212,000.00 Total cost Cost per EUP EUP 85,850 $ 3.30 35,350 $ 2.30 $ 283,305.00 81,305.00 364.610.00 $ 2,576.610.00 e. Prepare the number of equivalent units with respect to both materials red conversion costs in the production department for April using the FIFO method. Equivalent Units of Production - FIFO Units % Materials EUP. Materials EUP- Conversion Conversion 20% 15,800 80% 63,200 316,000 Units to complete beginning work in process Units started and completed Units in ending work in process Equivalent units of production 79,000 316,000 101,000 496.000 100% 85% 316,000 85,850 417,650 100% 35% 35,350 414,550 f. Compute the direct materials cost per equivalent unit for April. (Round "Cost per EUP" to 2 decimal places.) g. Compute the conversion cost per equivalent unit for April. (Round "Cost per EUP" to 2 decimal places.) h. Using the FIFO method, assign April's costs to the department's output-specifically, its units transferred to the next department and its ending work in process inventory. (Round "Cost per EUP" to 2 decimal places.) Required 1. and 2 Equivalent Units of Production (EUP)- FIFO Method Units % Materials EUP-Materials % Conversion EUP- Conversion Units completed and transferred out Units in ending work in process 0 Materials Conversion Costs Costs EUP 0 EUP 0 0 0 Equivalent units of production Cost per Equivalent Unit of Production Cost of beginning goods in process Total costs + Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total Costs to Account for: Direct materials prior period Conversion costs - prior period Direct materials - current period Conversion costs - current period Total costs to account for: Total costs accounted for Difference due to rounding cost/unit $ 0.00 $ 0.00 Required 3. Assignment of Costs to Output of Department Cost of 79.000 units from beginning inventory Beginning inventory EUP Cost per EUP Total cost $ 0.00 EUP Cost per Total cost EUP 0.00 $ $ 0.00 $ 0.00 0.00 Materials to complete Conversion to completo Total costs to complete Total cost of 79,000 units in beginning inventory Cost of units started and completed this period Direct materials Conversion costs Total cost of 316,000 units started and completed Total cost of 395,000 units transferred out Costs of units in ending inventory Direct materials Conversion costs Total cost of 101,000 units in ending inventory Total costs assigned EUP Total cost Cost per EUP $ 0.00 $ $ 0.00 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts