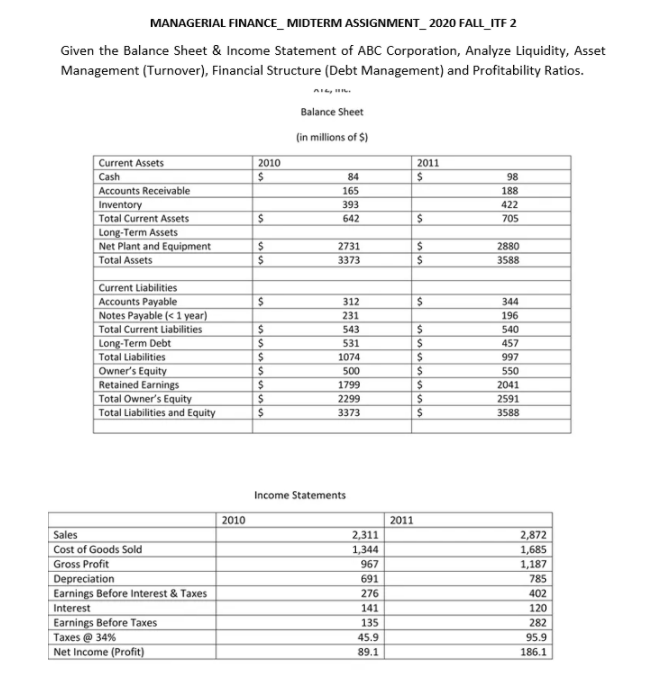

Question: MANAGERIAL FINANCE_MIDTERM ASSIGNMENT 2020 FALL_ITF 2 Given the Balance Sheet & Income Statement of ABC Corporation, Analyze Liquidity, Asset Management (Turnover), Financial Structure (Debt Management)

MANAGERIAL FINANCE_MIDTERM ASSIGNMENT 2020 FALL_ITF 2 Given the Balance Sheet & Income Statement of ABC Corporation, Analyze Liquidity, Asset Management (Turnover), Financial Structure (Debt Management) and Profitability Ratios. Sales Balance Sheet (in millions of $) Current Assets 2010 2011 Cash $ 84 $ 98 Accounts Receivable 165 188 Inventory 393 422 Total Current Assets $ 642 $ 705 Long-Term Assets Net Plant and Equipment $ 2731 $ 2880 Total Assets $ 3373 $ 3588 Current Liabilities Accounts Payable $ 312 $ 344 Notes Payable ( <1 year) 231 196 total current liabilities $ 543 540 long-term debt 531 457 1074 997 owner's equity 500 550 retained earnings 1799 2041 2299 2591 and 3373 3588 cost of goods sold gross profit depreciation before interest & taxes @ 34% net income (profit) statements 2010 2011 2,311 2,872 1,344 1,685 967 1,187 691 785 276 402 141 120 135 282 45.9 95.9 89.1 186.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts