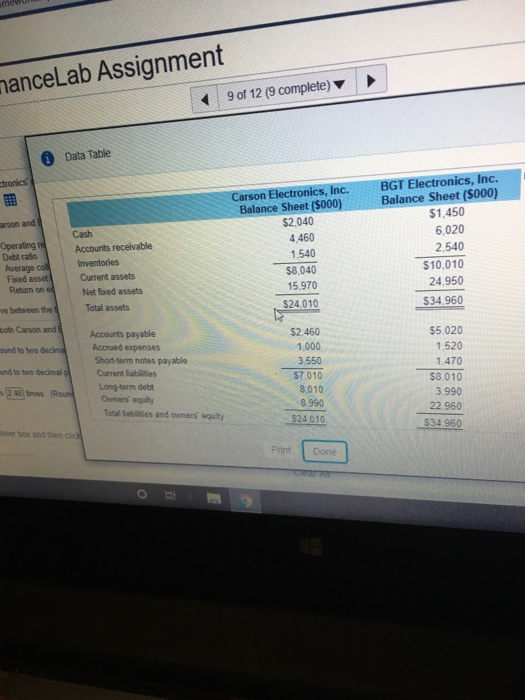

Question: manceLab Assignment 9 of 12 (9 complete) Data Table Stronics Carson Electronics, Inc. Balance Sheet($000) BGT Electronics, Inc. Balance Sheet (5000) $1,450 arson and $2,040

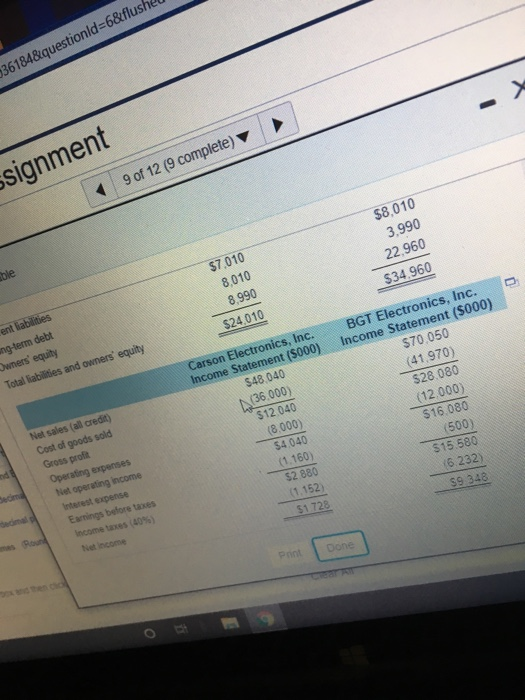

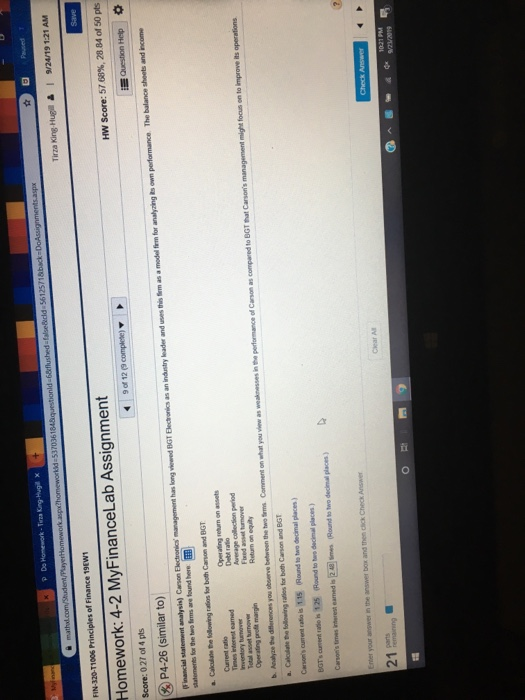

manceLab Assignment 9 of 12 (9 complete) Data Table Stronics Carson Electronics, Inc. Balance Sheet($000) BGT Electronics, Inc. Balance Sheet (5000) $1,450 arson and $2,040 4.460 1.540 58.040 6,020 2.540 $10,010 24,950 $34.960 15,970 $24.010 Cash Operating Accounts receivable Debt ratio Average col Inventories Faced asset Current assets Return on es Net foxed assets ve between the Total assets both Carson and Accounts payable ound to two decima Accrued expenses Short-term notes payable mund to two decimal Current liabilities Long-term debt 248 times. Round Owners' equity Total abilities and owners' equity Setox and then clic $2.460 1,000 3550 $7.010 8,010 $5,020 1.520 1.470 58 010 3.990 22.960 $34.960 8.990 $24.010 Print Done 36184&questionid=6&flushel ssignment 9 of 12 (9 complete) $8,010 3,990 22,960 $34.960 $7.010 8,010 8.990 $24.010 ent liabilities ong-term debt Owners' equity Total liabilities and owners' equity Carson Electronics, Inc. Income Statement (5000) $48.040 BGT Electronics, Inc. Income Statement ($000) $70.050 (41.970) $28.080 (12.000) 516.080 (500) (36.000) 12.040 (8,000) 54,040 515.580 6232) Net sales (all credit) Cost of goods sold Gross profit Operating expenses Het operating income Interest expense Earnings before taxes Income taxes (40%) Niet income (1.160) 52 880 (1.152) 59 348 51128 I pone P Do Homework - Turu King Hugil x mathal.com/Student/PlayerHomeworkshomeword=5370361848 questionid=6flushed=false&d=5612571&back DoAssignments.aspx * | 9/24/19 1:21 AM Tirza King Hugil Save FIN-320-T1006 Principles of Finance 1981 HW Score: 57.68%, 28.84 of 50 pts Homework: 4-2 MyFinanceLab Assignment Score: 0.27 of 4 pts 9 of 12 P4-26 (similar to) complete) Question Help for analyzing is own performance. The balance sheets and income an industry leader and h im as a model BGT Flechas Financial statement analysis) Caeson Electronics management has long statements for the two firms are found here: Calculate the following ratios for both Carson and BGT in the performance of Carson as compared to BGT that Carsor's management might focus on to improve its operations Current ratio Tineret med Dobroto Peverage collection period Total we move Featumover Operating profit margin Return on equity b. Analyze the differences you o ve between the twoms Comment on what you a. Calculate the following rates for both Carson and BGT Carson's current is 115 Round to two decimal places) BGTs cuentas 125 Round to be decimal places) Carson's time for samedi 24 mes Round to two decapaces) Enter your answer in the answer box and then click Check Answer Check Answer 21 pemaining " O 10:21 PM 2013

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts