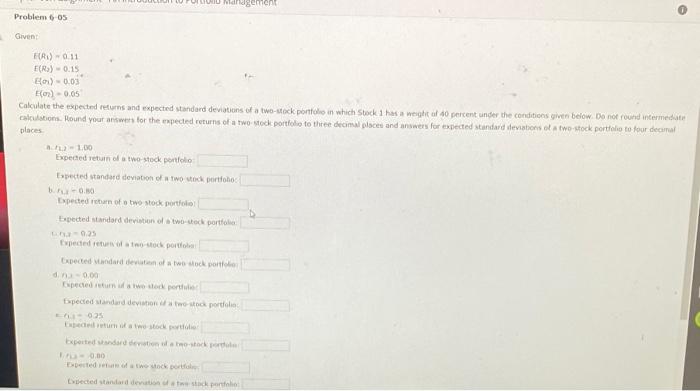

Question: Mandarin Problem 605 Given FR) 0.11 F(R) 0.15 E-0.03 EO) - 0,05 Callate the expected returns and expected standard deviations of a two-stock portfolio in

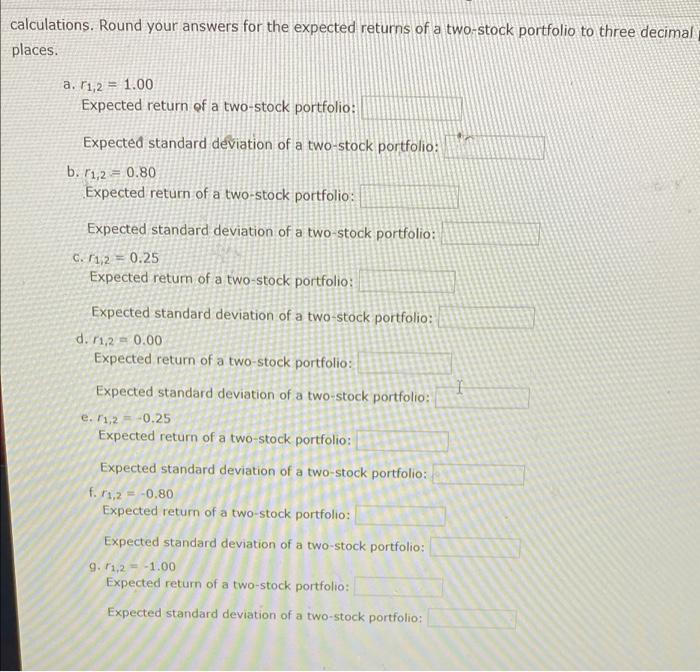

Mandarin Problem 605 Given FR) 0.11 F(R) 0.15 E-0.03 EO) - 0,05 Callate the expected returns and expected standard deviations of a two-stock portfolio in which stock has a weight al 10 percent under the conditions given below. Do not found intermediate calculation. Hound your answer for the expected returns of a two stock portfolio to three decimal places and answers for expected standard deviations of a two-stock portfolio to four decora places 1.00 Expected return of two stock portfolio tapected standard deviation of two stick porto -0.16 Expected of two stock portfolio Expected standard deviation of two-stock portfolio 0.25 Expeded return to porto Expected and even of two cockport din 0.00 pected return to port spected standard deviation to stock porto 025 Experte standard deviation to stop 0.00 Deted of two cockport Lected standard de perfil calculations. Round your answers for the expected returns of a two-stock portfolio to three decimal places. a. 11,2 = 1.00 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: b. 11,2 = 0.80 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: C. 11,2 = 0.25 Expected return of a two-stock portfolio: 1 Expected standard deviation of a two-stock portfolio: d. 11,2 = 0.00 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: e. 11,2 = -0.25 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: f. 71,2 = -0.80 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: 9. 1,2 = -1.00 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts