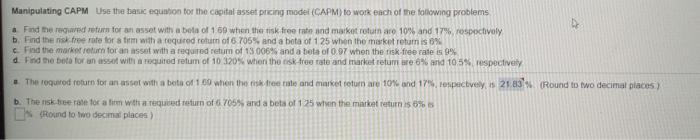

Question: Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of the following problems a Find the regard return

Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of the following problems a Find the regard return for an asset with a bota of 169 when the tisk free rate and market roturn aro 10% and 17% respectively b. Find the nisk free rate for a firm with a required return of 6 705% and a bota of 125 when the market return is 0% Find the market return for an asset with a required return of 13 006% anda bela of 0.97 when the the free rate is d. Find the bote for an asset with a required return of 10 3205 when the risk free rate and market retum reord 105% respectively The required return for an asset with a bota of 160 when the tree role and market return are 10% and 17% respectively, ns 2083 (Round to two decimal places) b. The store for a firm with a required return of 6705% and a bots of 15 when the market returns 0% Is Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts