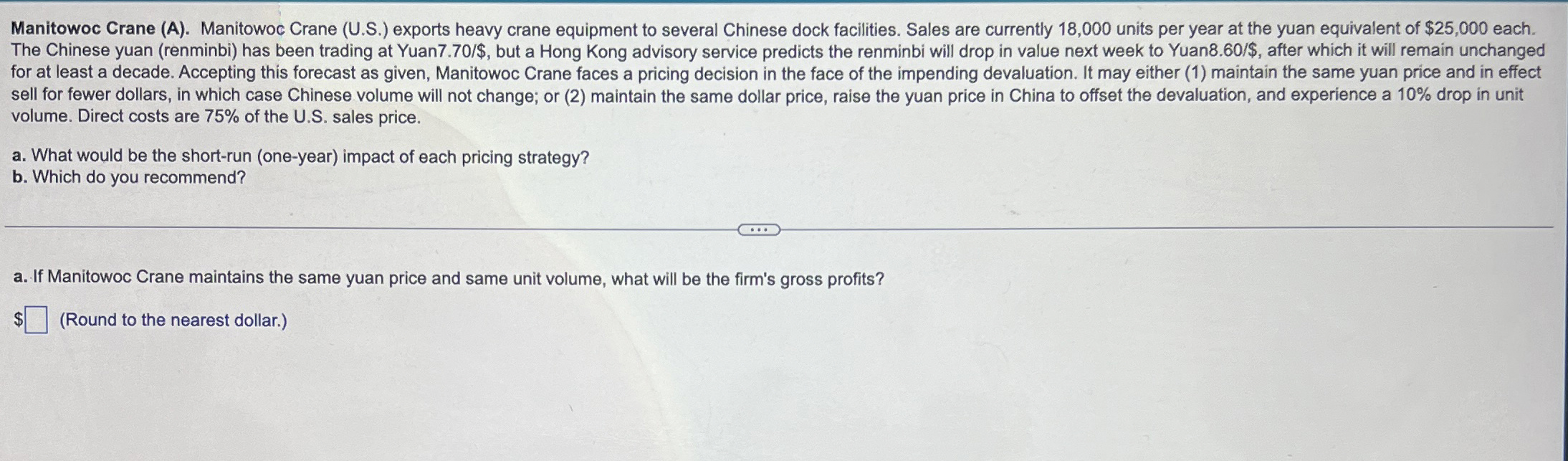

Question: Manitowoc Crane ( A ) . Manitowoc Crane ( U . S . ) exports heavy crane equipment to several Chinese dock facilities. Sales are

Manitowoc Crane A Manitowoc Crane US exports heavy crane equipment to several Chinese dock facilities. Sales are currently units per year at the yuan equivalent of $ each. The Chinese yuan renminbi has been trading at Yuan$ but a Hong Kong advisory service predicts the renminbi will drop in value next week to Yuan$ after which it will remain unchanged for at least a decade. Accepting this forecast as given, Manitowoc Crane faces a pricing decision in the face of the impending devaluation. It may either maintain the same yuan price and in effect sell for fewer dollars, in which case Chinese volume will not change; or maintain the same dollar price, raise the yuan price in China to offset the devaluation, and experience a drop in unit volume. Direct costs are of the US sales price.

a What would be the shortrun oneyear impact of each pricing strategy?

b Which do you recommend?

a If Manitowoc Crane maintains the same yuan price and same unit volume, what will be the firm's gross profits?

$ Round to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock