Question: Manto Realty Ltd. is a land developer with a calendar year end. When Manto needs capital to buy land, it often issues common shares, and

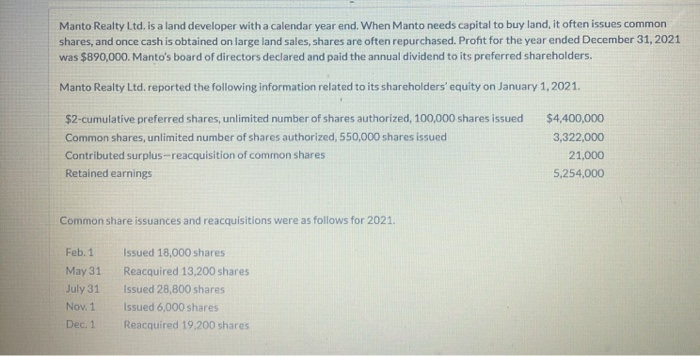

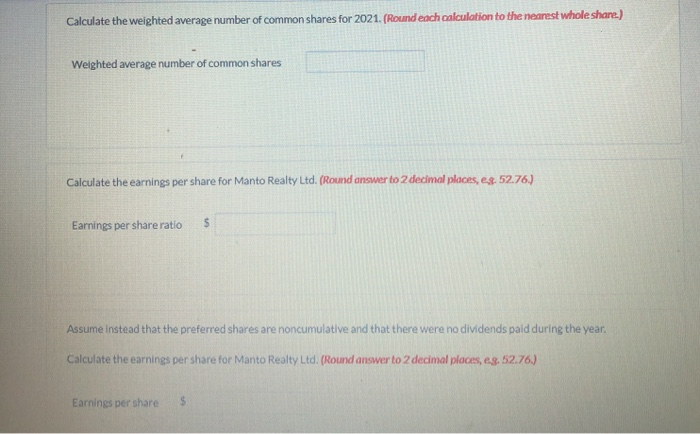

Manto Realty Ltd. is a land developer with a calendar year end. When Manto needs capital to buy land, it often issues common shares, and once cash is obtained on large land sales, shares are often repurchased. Profit for the year ended December 31, 2021 was $890,000. Manto's board of directors declared and paid the annual dividend to its preferred shareholders. Manto Realty Ltd. reported the following information related to its shareholders' equity on January 1, 2021. $2-cumulative preferred shares, unlimited number of shares authorized 100,000 shares issued $4,400,000 Common shares, unlimited number of shares authorized, 550,000 shares issued 3,322,000 Contributed surplus-reacquisition of common shares 21,000 Retained earnings 5,254,000 Common share issuances and reacquisitions were as follows for 2021. Feb. 1 May 31 July 31 Nov. 1 Dec. 1 Issued 18,000 shares Reacquired 13,200 shares Issued 28,800 shares Issued 6,000 shares Reacquired 19,200 shares Calculate the weighted average number of common shares for 2021. (Round each calculation to the nearest whole share.) Weighted average number of common shares Calculate the earnings per share for Manto Realty Ltd. (Round answer to 2 decimal places, s. 52.76.) Earnings per share ratio S Assume instead that the preferred shares are noncumulative and that there were no dividends paid during the year. Calculate the earnings per share for Manto Realty Ltd. (Round answer to 2 decimal places, eg. 52.76.) Earnings per share $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts