Question: MANUAL SOLUTION PLS! NO TO EXCEL 1. An asset for drilling was purchased and placed in service by a petroleum production company. Its cost basis

MANUAL SOLUTION PLS!

NO TO EXCEL

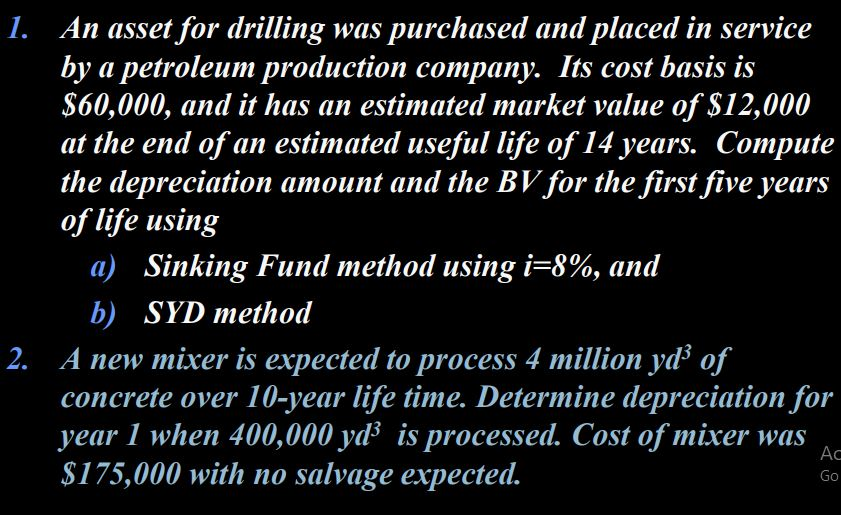

1. An asset for drilling was purchased and placed in service by a petroleum production company. Its cost basis is $60,000, and it has an estimated market value of $12,000 at the end of an estimated useful life of 14 years. Compute the depreciation amount and the BV for the first five years of life using a) Sinking Fund method using i=8%, and b) SYD method 2. A new mixer is expected to process 4 million yd of concrete over 10-year life time. Determine depreciation for year 1 when 400,000 yd is processed. Cost of mixer was $175,000 with no salvage expected. Ac Go

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock