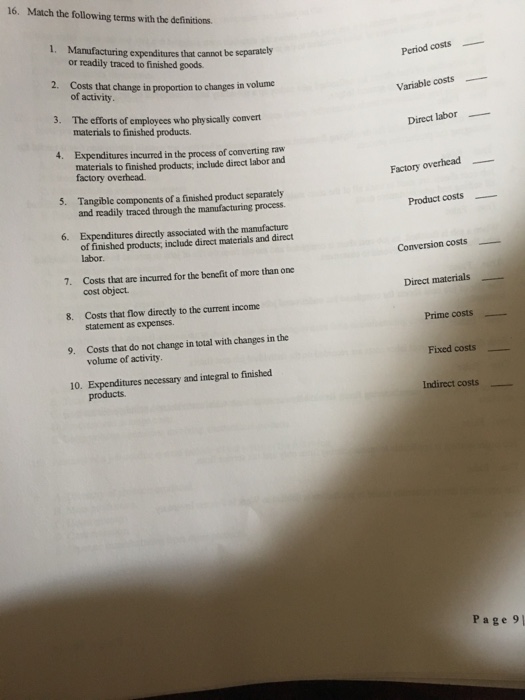

Question: Manufacturing expenditures that cannot be separately or readily traced to finished goods. Period costs. Cost that changes in proportion to changes in volume of activity.

Manufacturing expenditures that cannot be separately or readily traced to finished goods. Period costs. Cost that changes in proportion to changes in volume of activity. Variable costs The efforts of employees who physically convert materials to finished products. Direct labor Expenditures incurred in the process of converting raw materials to finished products, include direct labor and factory overhead. Factory overhead. Tangible components of a finished product separately and readily traced through the manufacturing process. Product cost Expenditures directly associated with the manufacture of finished products, include direct medals and direct labor. Conversion costs Costs that are incurred for the benefit of more than one cost object. Direct material Costs that flow directly to the current income statement as expenses. Prime costs Costs that do not change in total with changes in the volume of activity. Fixed costs Expenditures necessary and integral to finished products. Indirect costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts