Question: Manufacturing Overhead ( MO ) Assumptions Variable overhead rate / direct labor hour 1 2 . 5 0 Fixed MO per quarter $ 1 7

Manufacturing Overhead MO Assumptions Variable overhead ratedirect labor hour Fixed MO per quarter $ Fixed MO per month $ MO Depreciation per quarter $ Depreciation per month $ SGA Assumptions Variable SGA per unit $ Variable shipping per unit $ Advertising expenses per month $ Executive salaries per month $ SG&A Depreciation expense per month $ Rent expense per month $ Insurance expense per month $ Cash Budget Assumptions Beginning Cash Balance $ Dividends $ Minimum Cash Balance $ Annual Interest Rate Monthly Interest Rate Other Balance Sheet Data Land $ Building Improvements $ Common Stock $ Retained Earnings $ Building Improvements $ Useful life Annual Dep $ Monthly Dep $ Portion of remodel for Admin Offices Portion of remodel for Manufacturing Selling, General & Administrative Depreciation $ Manufacturing Overhead Depreciation $begintabularllllll

hline & & & & &

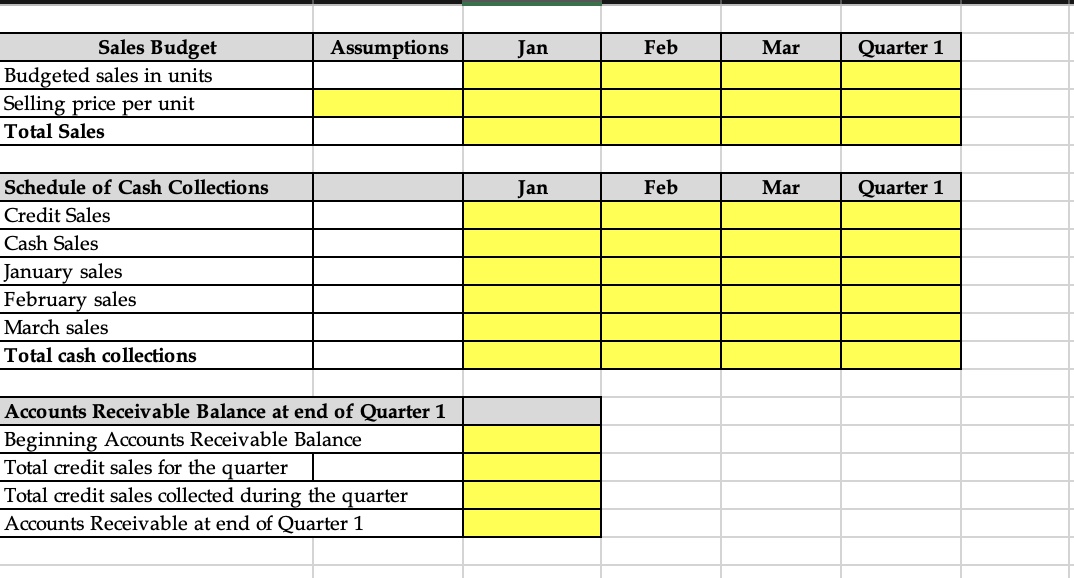

hline Sales Budget & Assumptions & Jan & Feb & Mar & Quarter

hline Budgeted sales in units & & & & &

hline Selling price per unit & & & & &

hline Total Sales & & & & &

hline & & & & &

hline Schedule of Cash Collections & & Jan & Feb & Mar & Quarter

hline Credit Sales & & & & &

hline Cash Sales & & & & &

hline January sales & & & & &

hline February sales & & & & &

hline March sales & & & & &

hline Total cash collections & & & & &

hline multicolumnc

hline Accounts Receivable Balance at end of Quarter & & & & &

hline multicolumnlBeginning Accounts Receivable Balance & & & &

hline Total credit sales for the quarter & & & & &

hline multicolumnlTotal credit sales collected during the quarter & & & &

hline multicolumnlAccounts Receivable at end of Quarter & & & &

hline & & & & &

hline

endtabular

hint: The end of quarter desired ending inventory will not be the total of the three months.

hint: The ending balance of one period is the beginning balance of the next so March and the Quarter will have a different beginning inventory begintabularlllll

hline Direct Labor Budget & Jan & Feb & Mar & Quarter

hline Required production & & & &

hline Direct labor hours per unit & & & &

hline multicolumnlTotal direct labor hours needed & & &

hline Direct Labor cost per hour & & & &

hline Total Direct Labor Cost Round to the nearest whole dollar & & & &

hline

endtabularbegintabularlllll

hline Manufacturing Overhead Budget & Jan & Feb & Mar & Quarter

hline Budgeted direct labor hours & & & &

hline Variable manufacturing overhead rate & & & &

hline Variable manufacturing overhead cost & & & &

hline Fixed manufacturing overhead & & & &

hline Total manufacturing overhead & & & &

hline Less: Depreciation & & & &

hline Cash disbursements for MO & & & &

hline & & & &

hline Total manufacturing overhead & & & &

hline Budgeted direct labor hours & & & &

hline Predetermined overhead rate & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock