Question: many thanks! turn to quest Problem 8-5A (Algo) Computing and revising depreciation; selling plant assets LO C2, P1, P2 Yoshi Company completed the following transactions

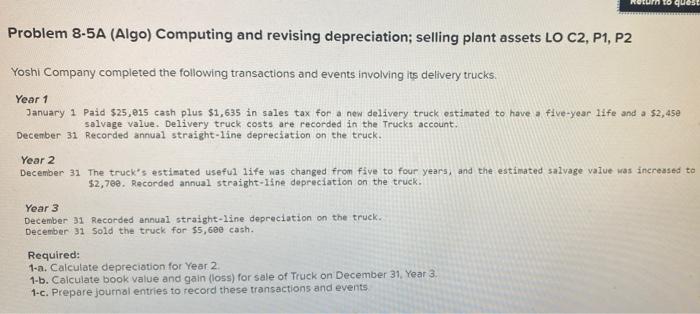

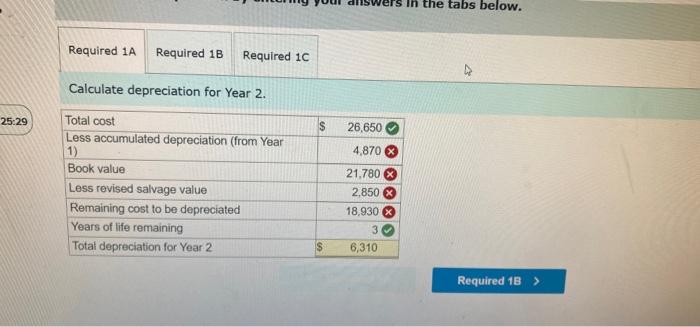

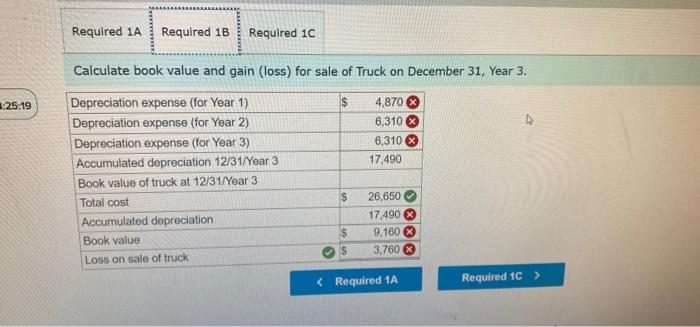

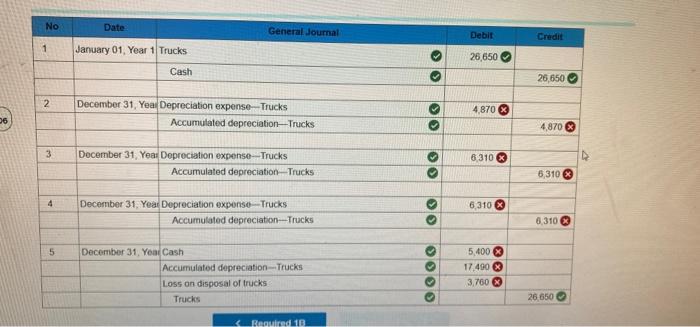

turn to quest Problem 8-5A (Algo) Computing and revising depreciation; selling plant assets LO C2, P1, P2 Yoshi Company completed the following transactions and events involving its delivery trucks. Year 1 January 1 Paid $25,815 cash plus $1.635 in sales tax for a new delivery truck estimated to have a five-year life and a $2,452 salvage value. Delivery truck costs are recorded in the Trucks account. December 31 Recorded annual straight-line depreciation on the truck. Year 2 December 31 The truck's estimated useful life was changed from five to four years, and the estimated salvage value was increased to $2,700. Recorded annual straight-line depreciation on the truck. Year 3 December 31 Recorded annual straight-line depreciation on the truck December 31 Sold the truck for $5,600 cash. Required: 1-a. Calculate depreciation for Year 2 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare journal entries to record these transactions and events the tabs below. Required 1A Required 1B Required 10 Calculate depreciation for Year 2 25:29 $ 26,650 Total cost Less accumulated depreciation (from Year 1) Book value Less revised salvage value Remaining cost to be depreciated Years of life remaining Total depreciation for Year 2 4,870 21.780 2,850 X 18,930 X 3 6,310 Required 1B > Required 1A Required 1B Required 10 Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 3:25:19 S 4,870 % 6,310 6,310 17,490 Depreciation expense (for Year 1) Depreciation expense (for Year 2) Depreciation expense (for Year 3) Accumulated depreciation 12/31/Year 3 Book value of truck at 12/31/Year 3 Total cost Accumulated depreciation Book value Loss on sale of truck $ 26,650 $ $ 17,490 X 9,160 3,760 3 No Date General Journal Debit Credit January 01, Year 1 Trucks > 26,650 Cash O 26,650 2 December 31, Yoal Depreciation expense Trucks Accumulated depreciation--Trucks 4,870 X 26 4,870 X 3 6.310 X V December 31, Year Depreciation expense-Trucks Accumulated depreciation - Trucks Blo 6,310 4 6 310 December 31, Year Depreciation exponse Trucks Accumulated depreciation---Trucks 8.310 3 5 December 31, Year Cash Accumulated depreciation Trucks Loss on disposal of trucks Trucks 5.400 17.490 3.760 26 650

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts