Question: Map Apply Search/A-Z RE Sites 267 Hide Time Remaining A Question 5 of 25 5 Points Questions 1 - 6 are all based on the

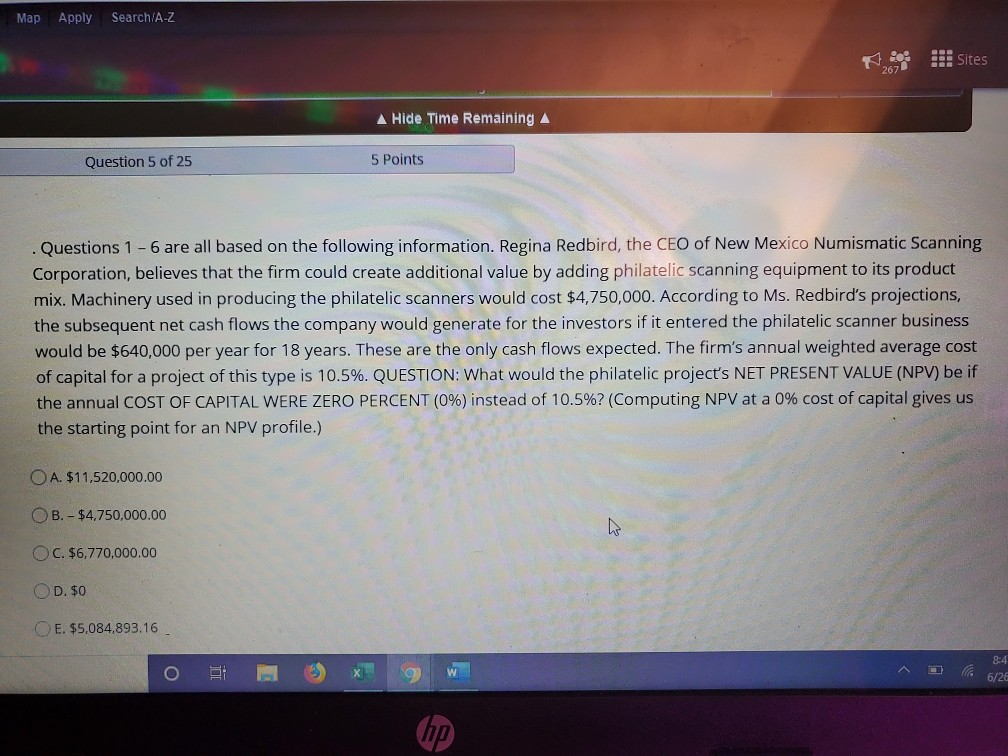

Map Apply Search/A-Z RE Sites 267 Hide Time Remaining A Question 5 of 25 5 Points Questions 1 - 6 are all based on the following information. Regina Redbird, the CEO of New Mexico Numismatic Scanning Corporation, believes that the firm could create additional value by adding philatelic scanning equipment to its product mix. Machinery used in producing the philatelic scanners would cost $4,750,000. According to Ms. Redbird's projections, the subsequent net cash flows the company would generate for the investors if it entered the philatelic scanner business would be $640,000 per year for 18 years. These are the only cash flows expected. The firm's annual weighted average cost of capital for a project of this type is 10.5%. QUESTION: What would the philatelic project's NET PRESENT VALUE (NPV) be if the annual COST OF CAPITAL WERE ZERO PERCENT (0%) instead of 10.5%? (Computing NPV at a 0% cost of capital gives us the starting point for an NPV profile.) O A. $11,520,000.00 OB. - $4.750,000.00 OC. $6,770,000.00 D. $0 E. $5,084,893.16 O X W 8-4 6/26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts