Question: MAP4C Assignment 16 Budget Case Studies Case Study F 1 - Natalie's situation Natalie has found a new job in Windsor, which pays her $23

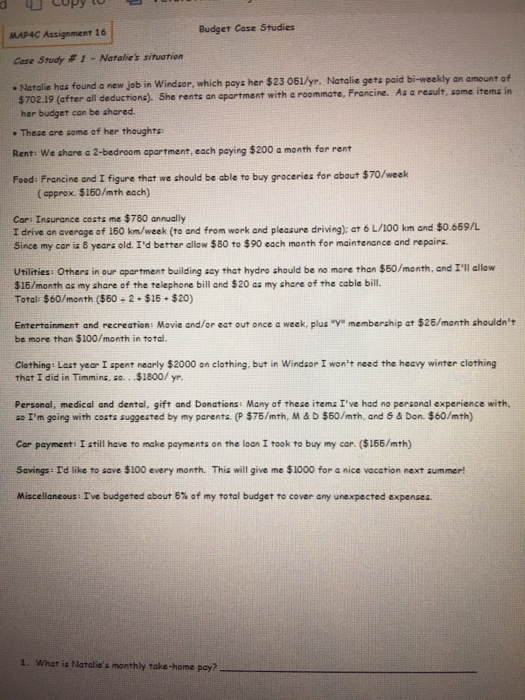

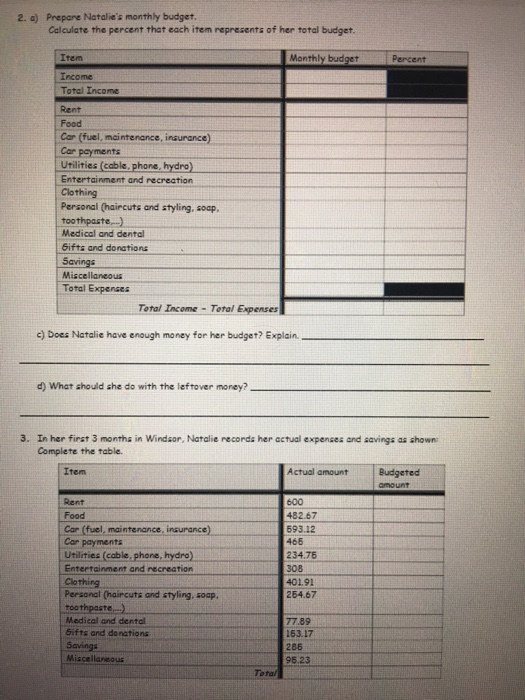

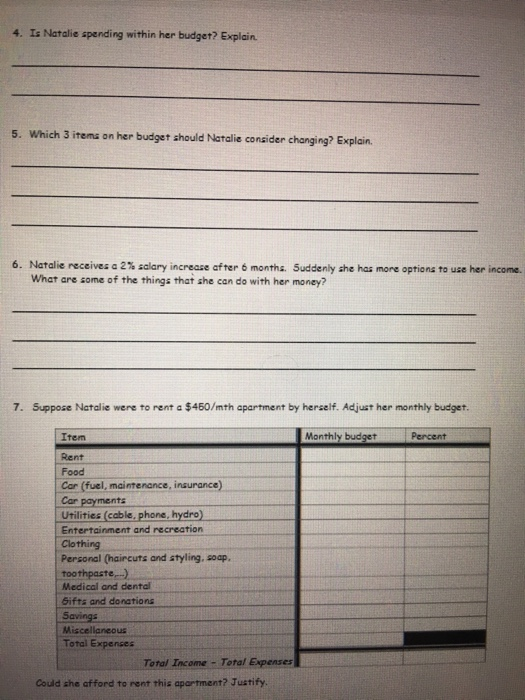

MAP4C Assignment 16 Budget Case Studies Case Study F 1 - Natalie's situation Natalie has found a new job in Windsor, which pays her $23 061/yr. Natalie gets paid bi-weekly an amount of $702.19 (after all deductions). She rents an apartment with a roommate, Francine. As a result, some items in her budget can be shared. These are some of her thoughts Rent: We share a 2-bedroom apartment, each paying $200 a month for rent Foods Francine and I figure that we should be able to buy groceries for about $70/week (approx. $160/mth each) Car Insurance costs me $780 annually I drive an average of 160 km/week (to and from work and pleasure driving); at 6 L/100 km and $0.669/L Since my car is 8 years old. I'd better allow $80 to $90 each month for maintenance and repairs. Utilities: Others in our apartment building say that hydro should be no more than $50/month, and I'll allow $16/month as my share of the telephone bill and $20 as my share of the cable bill. Total: $60/month ($60 = 2 - $16 - $20) Entertainment and recreation Movie and/or eat out once a week, plus "Y" membership at $26/month shouldn't be more than $100/month in total. Clothing: Last year I spent nearly $2000 on clothing, but in Windsor I won't need the heavy winter clothing that I did in Timmins, so.. $1800/ yr. Personal, medical and dental, gift and Donations: Many of these items I've had no personal experience with so I'm going with costs suggested by my parents. (P $76/mth, M&D $50/mth, and 6 a Don $60/mth) Car payment: I still have to make payments on the loon I took to buy my car. ($166/mth) Sevings: I'd like to save $100 every month. This will give me $ 1000 for a nice vacation next summer! Miscellaneous : I've budgeted about 5% of my total budget to cover any unexpected expenses. 1. What is Natalie's monthly take-home pey? 2. a) Prepare Natalie's monthly budget. Calculate the percent that each item represents of her total budget. Monthly budget Percent Item Income Total Income Rent Food Car (fuel, maintenance, insurance) Car payments Utilities (cable, phone, hydro) Entertainment and recreation Clothing Personal (haircuts and styling, soap, toothpaste...) Medical and dental Gifts and donations Savings Miscellaneous Total Expenses Total Income - Total Expenses c) Does Natalie have enough money for her budget? Explain. .) What should she do with the leftover money? 3. In her first 3 months in Windsor, Natalie records her actual expenses and savings as shown Complete the table. Item Actual amount Budgeted amount Rent Food Car (fuel, maintenance insurance) Car payments Utilities (cable, phone, hydro) Entertainment and recreation Clothing Personal (haircuts and styling, soap. Toothpaste..) Medical and dental Sifts and donations Savings Miscellaneous 600 482.67 693.12 465 234.76 308 401.91 254.67 77.89 163.17 285 95.23 Total 4. Is Natalie spending within her budget? Explain 5. Which 3 items on her budget should Natalie consider changing? Explain. 6. Natalie receives a 2% salary increase after 6 months. Suddenly she has more options to use her income. What are some of the things that she can do with her money? 7. Suppose Natalie were to rent a $450/mth apartment by herself. Adjust her monthly budget. Item Monthly budget Percent Rent Food Car (fuel, maintenance, insurance) Car payments Utilities (cable, phone, hydro) Entertainment and recreation Clothing Personal (haircuts and styling, soap. Toothpaste...) Medical and dental Gifts and donations Savings Miscellaneous Total Expenses Total Income - Total Expenses Could she afford to rent this apartment? Justify

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts