Question: map/indexhtml?_con=conexternal_browser=0&launchur-https%253A%252F%252F ment 7 (Chapter 8 Help You received no credit for this question in the previous attempt 15 V art 2 of 3 Required information

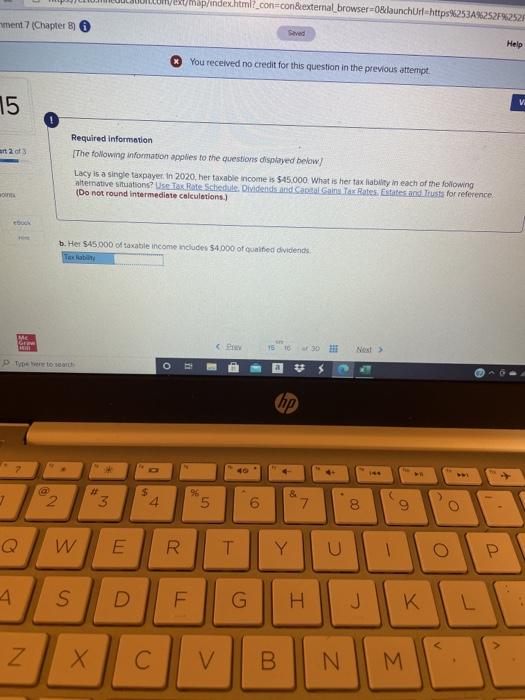

map/indexhtml?_con=conexternal_browser=0&launchur-https%253A%252F%252F ment 7 (Chapter 8 Help You received no credit for this question in the previous attempt 15 V art 2 of 3 Required information The following information applies to the questions displayed below Lacy is a single taxpayer. In 2020, her taxable income is $45.000 What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule. Dividends and Canal Gain Tax Rates. Estates and tests for reference (Do not round intermediate calculations.) b. Her $45000 of taxable income includes $4.000 of Guated dividends ME La 151 Typerto hp 4 7 & 2 $ 4 3 96 5 6 17 8 Q W E R T T Y ul 1 O P 4 S D F H N C V B N M M map/indexhtml?_con=conexternal_browser=0&launchur-https%253A%252F%252F ment 7 (Chapter 8 Help You received no credit for this question in the previous attempt 15 V art 2 of 3 Required information The following information applies to the questions displayed below Lacy is a single taxpayer. In 2020, her taxable income is $45.000 What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule. Dividends and Canal Gain Tax Rates. Estates and tests for reference (Do not round intermediate calculations.) b. Her $45000 of taxable income includes $4.000 of Guated dividends ME La 151 Typerto hp 4 7 & 2 $ 4 3 96 5 6 17 8 Q W E R T T Y ul 1 O P 4 S D F H N C V B N M M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts