Question: Marble Construction estimates that its WACC is 12% if equity comes from retained earnings. However, if the company issues new stock to raise new equity,

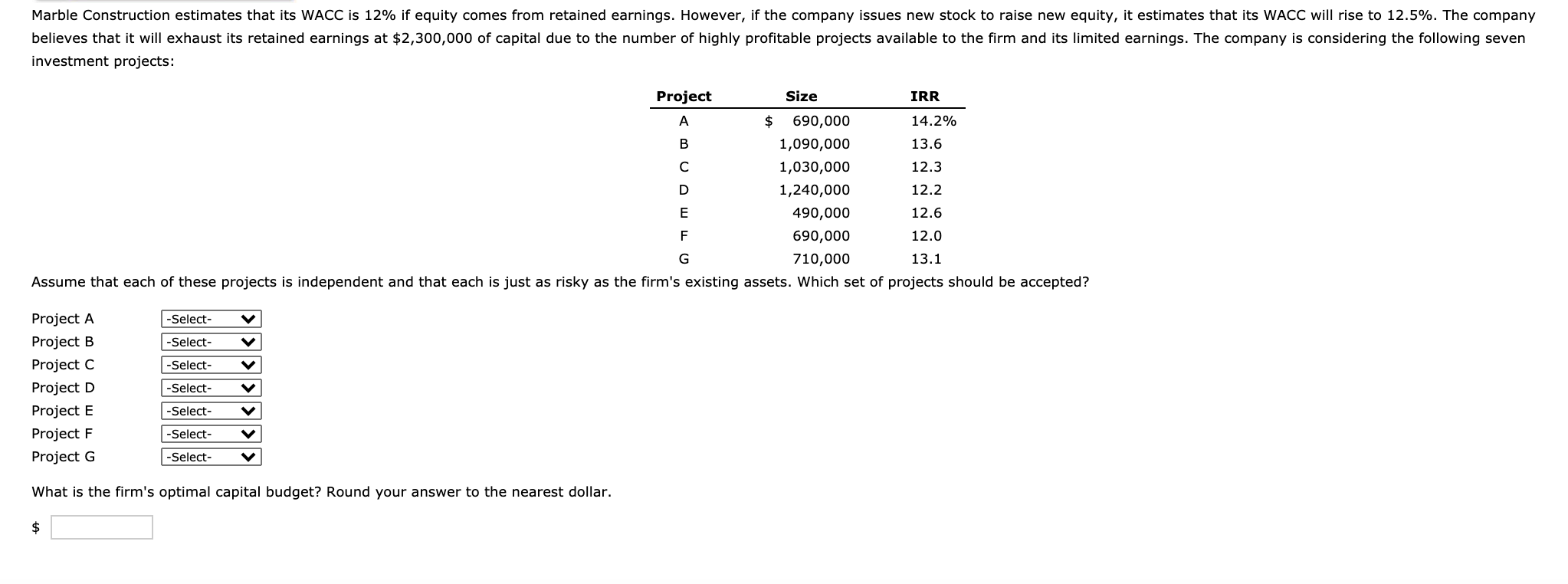

Marble Construction estimates that its WACC is 12% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 12.5%. The company believes that it will exhaust its retained earnings at $2,300,000 of capital due to the number of highly profitable projects available to the firm and its limited earnings. The company is considering the following seven investment projects: Project Size IRR A $ 690,000 14.2% B 1,090,000 13.6 1,030,000 12.3 D 1,240,000 12.2 E 490,000 12.6 F 690,000 12.0 G 710,000 13.1 Assume that each of these projects is independent and that each is just as risky as the firm's existing assets. Which set of projects should be accepted? -Select- -Select- -Select- Project A Project B Project C Project D Project E Project F Project G -Select- -Select- -Select- -Select- What is the firm's optimal capital budget? Round your answer to the nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts