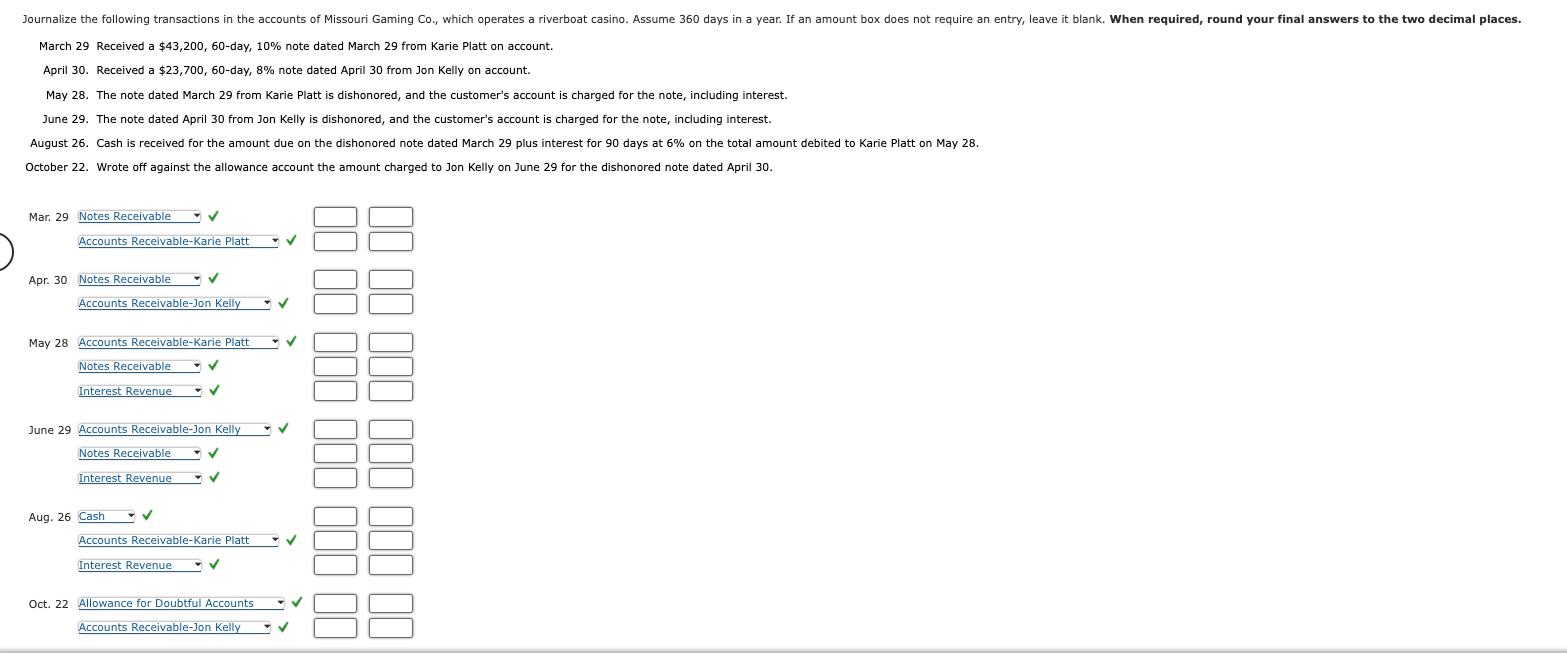

Question: March 2 9 Received a $ 4 3 , 2 0 0 , 6 0 - day, 1 0 % note dated March

March Received a $day, note dated March from Karie Platt on account.

April Received a $ day, note dated April from Jon Kelly on account.

May The note dated March from Karie Platt is dishonored, and the customer's account is charged for the note, including interest.

June The note dated April from Jon Kelly is dishonored, and the customer's account is charged for the note, including interest.

August Cash is received for the amount due on the dishonored note dated March plus interest for days at on the total amount debited to Karie Platt on May

October Wrote off against the allowance account the amount charged to Jon Kelly on June for the dishonored note dated April

Mar. Notes Receivable

Accounts ReceivableKarie Platt

Apr. Notes Receivable

Accounts ReceivableJon Kelly

May Accounts ReceivableKarie Platt

Notes Receivable

Interest Revenue

June Accounts ReceivableJon Kelly

Notes Receivable

Interest Revenue

Aug. Cash downarrow

Accounts ReceivableKarie Platt

Interest Revenue

Oct. Allowance for Doubtful Accounts

Accounts ReceivableJon Kelly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock