Question: Margaret Grey has just approached a venture capitalist for financing for her new business venture, the development of a local ski hill. On July

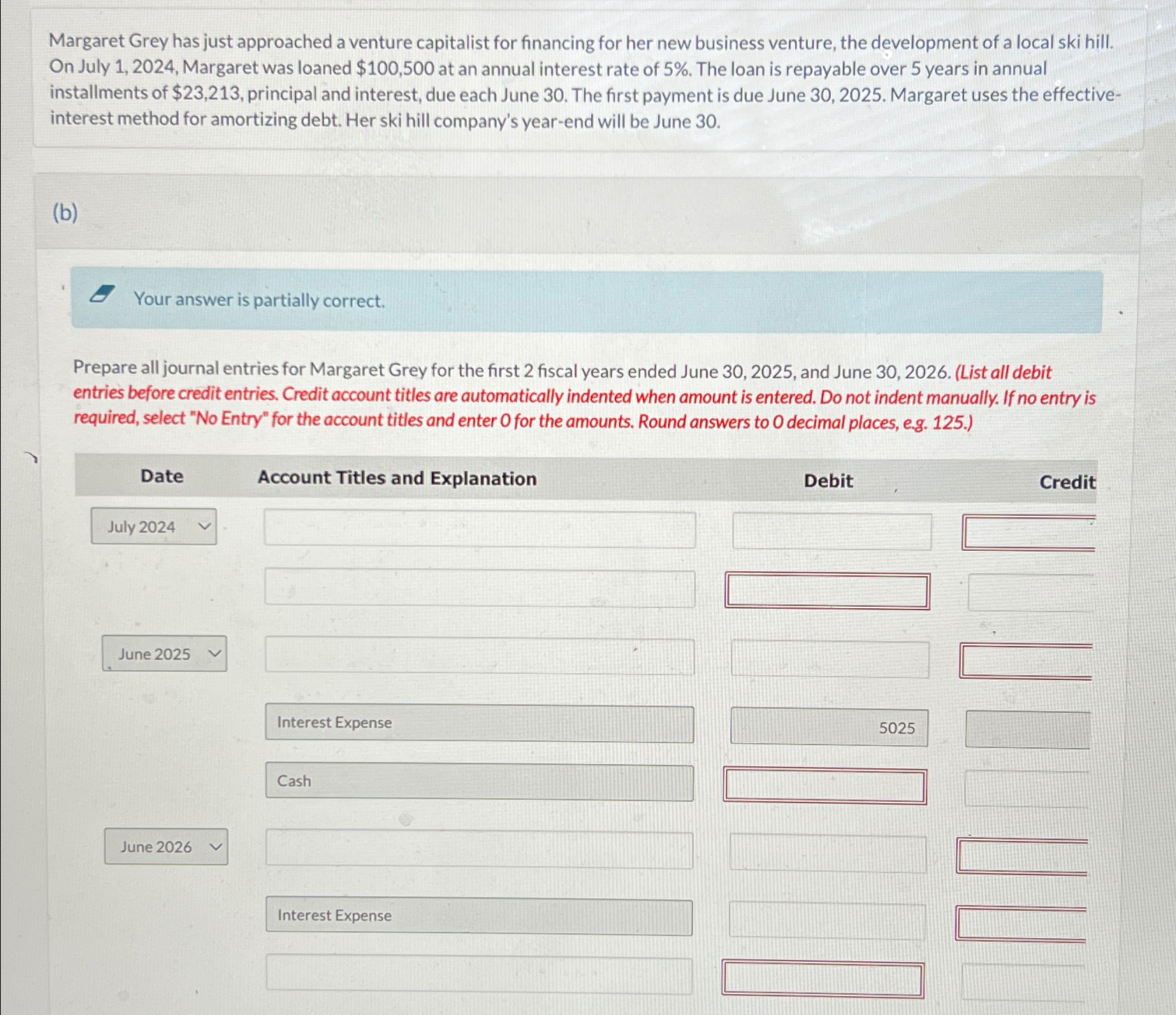

Margaret Grey has just approached a venture capitalist for financing for her new business venture, the development of a local ski hill. On July 1, 2024, Margaret was loaned $100,500 at an annual interest rate of 5%. The loan is repayable over 5 years in annual installments of $23,213, principal and interest, due each June 30. The first payment is due June 30, 2025. Margaret uses the effective- interest method for amortizing debt. Her ski hill company's year-end will be June 30. (b) Your answer is partially correct. Prepare all journal entries for Margaret Grey for the first 2 fiscal years ended June 30, 2025, and June 30, 2026. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 125.) Date July 2024 June 2025 June 2026 Account Titles and Explanation Debit Interest Expense 5025 Cash Interest Expense Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts