Question: Margin Account & Margin Call Suppose the current price for Stock K is $10 per share. An investor wants to buy $2,000 worth of stock

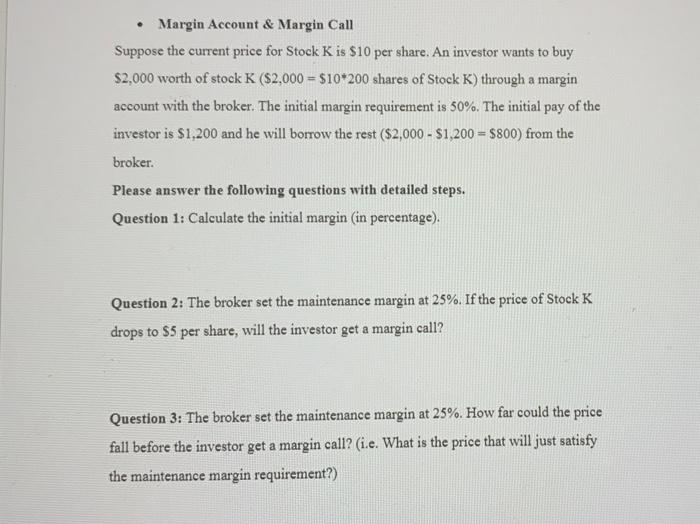

Margin Account & Margin Call Suppose the current price for Stock K is $10 per share. An investor wants to buy $2,000 worth of stock K ($2,000 = $10*200 shares of Stock K) through a margin account with the broker. The initial margin requirement is 50%. The initial pay of the investor is $1,200 and he will borrow the rest ($2,000 - $1,200 = $800) from the broker. Please answer the following questions with detailed steps. Question 1: Calculate the initial margin (in percentage). Question 2: The broker set the maintenance margin at 25%. If the price of Stock K drops to $5 per share, will the investor get a margin call? Question 3: The broker set the maintenance margin at 25%. How far could the price fall before the investor get a margin call? (i.e. What is the price that will just satisfy the maintenance margin requirement?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts