Question: Mari Time: 24 con Question Completion Status Suppose that we have two countries with similar households: the consumption functions of Country A is A200+ 0.8(T)

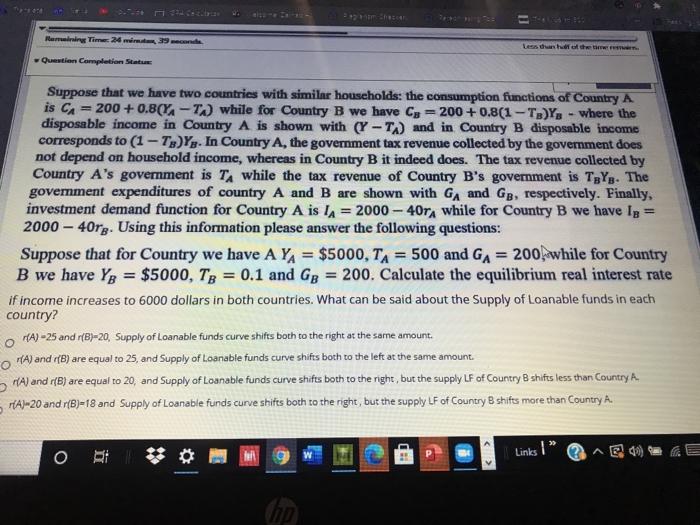

Mari Time: 24 con Question Completion Status Suppose that we have two countries with similar households: the consumption functions of Country A is A200+ 0.8(T) while for Country B we have Cy=200+ 0.8(1 --TB)Ys - where the disposable income in Country A is shown with (Y-T.) and in Country B disposable income corresponds to (1 - TgYg. In Country A, the government tax revenue collected by the government does not depend on household income, whereas in Country B it indeed does. The tax revenue collected by Country A's government is TA while the tax revenue of Country B's government is TgYg. The goverment expenditures of country A and B are shown with GA and GB, respectively. Finally, investment demand function for Country A is 2000 - 40rA while for Country B we have Ig 2000 - 40rg. Using this information please answer the following questions: Suppose that for Country we have A YA = $5000, TA 500 and GA = 200, while for Country B we have Yo = $5000, Tg = 0.1 and GB = 200. Calculate the equilibrium real interest rate if income increases to 6000 dollars in both countries. What can be said about the supply of Loanable funds in each country? or(A) -25 and r(B)-20, Supply of Loanable funds curve shifts both to the right at the same amount. (A) and (8) are equal to 25, and Supply of Loanable funds curve shifts both to the left at the same amount. A) and r(B) are equal to 20, and Supply of Loanable funds curve shifts both to the right, but the supply LF of Country B shifts less than Country A Al-20 and r(B)-18 and Supply of Loanable funds curve shifts both to the right, but the supply LF of Country B shifts more than Country A. O * Links Mari Time: 24 con Question Completion Status Suppose that we have two countries with similar households: the consumption functions of Country A is A200+ 0.8(T) while for Country B we have Cy=200+ 0.8(1 --TB)Ys - where the disposable income in Country A is shown with (Y-T.) and in Country B disposable income corresponds to (1 - TgYg. In Country A, the government tax revenue collected by the government does not depend on household income, whereas in Country B it indeed does. The tax revenue collected by Country A's government is TA while the tax revenue of Country B's government is TgYg. The goverment expenditures of country A and B are shown with GA and GB, respectively. Finally, investment demand function for Country A is 2000 - 40rA while for Country B we have Ig 2000 - 40rg. Using this information please answer the following questions: Suppose that for Country we have A YA = $5000, TA 500 and GA = 200, while for Country B we have Yo = $5000, Tg = 0.1 and GB = 200. Calculate the equilibrium real interest rate if income increases to 6000 dollars in both countries. What can be said about the supply of Loanable funds in each country? or(A) -25 and r(B)-20, Supply of Loanable funds curve shifts both to the right at the same amount. (A) and (8) are equal to 25, and Supply of Loanable funds curve shifts both to the left at the same amount. A) and r(B) are equal to 20, and Supply of Loanable funds curve shifts both to the right, but the supply LF of Country B shifts less than Country A Al-20 and r(B)-18 and Supply of Loanable funds curve shifts both to the right, but the supply LF of Country B shifts more than Country A. O * Links

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts