Question: Marigold has already made an entry that established the incorrect December 3 1 , 2 0 2 5 , inventory amount. 3 . At December

Marigold has already made an entry that established the incorrect December inventory amount.

At December Marigold decided to change the depreciation method on its office equipment from doubledecliningbalance to straightline. The equipment had an original cest of $ when purchased on January It has a vear useful life and no salvage value. Depreciation eppense recorded prior to under the doubledecliningbalance method was $ Marigold has already recorded depreclation epense of $ using the doubledecliningbalance method.

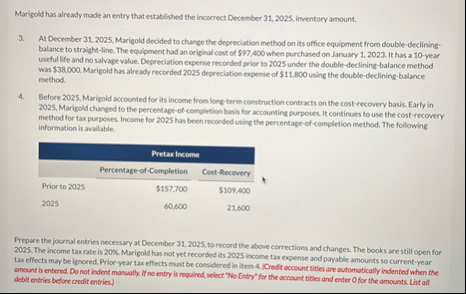

Before Marigold accounted for its income from longterm construction contracts on the costrecovery basis. Early in Marigold changed to the percentageofcompletion basis for accounting purposes. It continues to use the costrecovery method for tax purposes. Income for has been recorded uting the percentageofcompletion method. The following information is available.

tablePretar IncemePercentageofCompletion,ContRecoveryPrior to $

Prepare the journal entries necessary at December to record the above corrections and changes. The books are still open for The income tax rate is Marigold has not yet recorded its income tax expense and payable amounts so currentyear tax effects may be ignored. Prioryear tax effects must be considered in itiem ICredit account titler are outomatically indented when the amount Is entered. Do not indent manually. If no entry is required, select 'Tis Entry' for the account tibles and enter Ofor the amounts. List alf debit entries before credit entries.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock