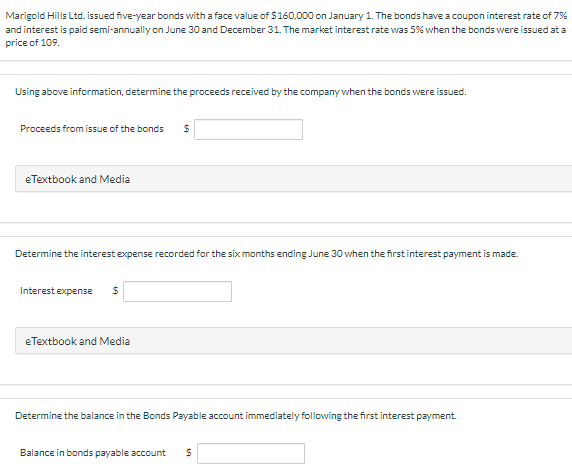

Question: Marigold Hills Ltd. issued five-year bonds with a face value of $160,000 on January 1. The bonds have a coupon interest rate of 7%

Marigold Hills Ltd. issued five-year bonds with a face value of $160,000 on January 1. The bonds have a coupon interest rate of 7% and interest is paid semi-annually on June 30 and December 31. The market interest rate was 5% when the bonds were issued at a price of 109. Using above information, determine the proceeds received by the company when the bonds were issued. Proceeds from issue of the bonds $ eTextbook and Media Determine the interest expense recorded for the six months ending June 30 when the first interest payment is made. Interest expense $ eTextbook and Media Determine the balance in the Bonds Payable account immediately following the first interest payment. Balance in bonds payable account $

Step by Step Solution

There are 3 Steps involved in it

Proceeds from Issuance The market price of the bond reflects the difference between the coupon interest rate 7 and the market interest rate 5 Since th... View full answer

Get step-by-step solutions from verified subject matter experts