Question: Marin Enterprises has three notes payable outstanding on December 31, 2024, as follows: 1. 2. 3. A six-year, 6%, $80,400 note payable issued on March

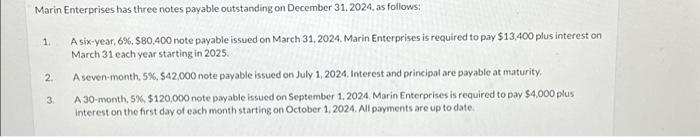

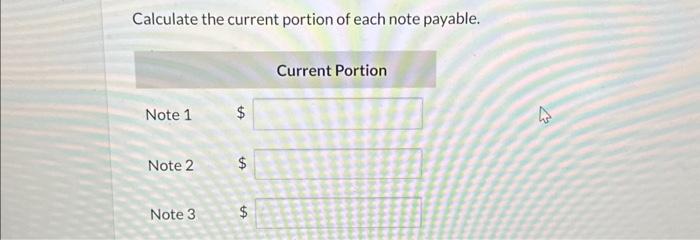

Marin Enterprises has three notes payable outstanding on December 31, 2024, as follows: 1. A six-year, 6%,$80,400 note payable issued on March 31, 2024, Marin Enterprises is required to payy $13,400 plus interest on March 31 each year starting in 2025. 2. A seven-month, 5%,$42,000 note payable issued on July 1, 2024, Interest and principal are payable at maturity. 3. A 30 -month, 5%,$120,000 note payable issued on September 1,2024. Marin Enterpeises is required to pay $4,000 plus interest on the first day of each month starting on October 1.2024. Al payments are up to date. Calculate the current portion of each note payable. Current Portion Note 1 \$ Note 2 \$ Note 3$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts