Question: Mario operates a cash - basis, calendar year - end pizzeria business. At the end of the year he received a $ 1 2 ,

Mario operates a cashbasis, calendar yearend pizzeria business. At the end of the year he received a $ bill for pizza sauce and was given year to pay it with no penalties or late fees. Mario's marginal tax rate is this year and next year. Assume that he can earn an aftertax rate of return of on investments.

When should he pay the $ billthis year or next? What is the total after tax cost of paying the bill?

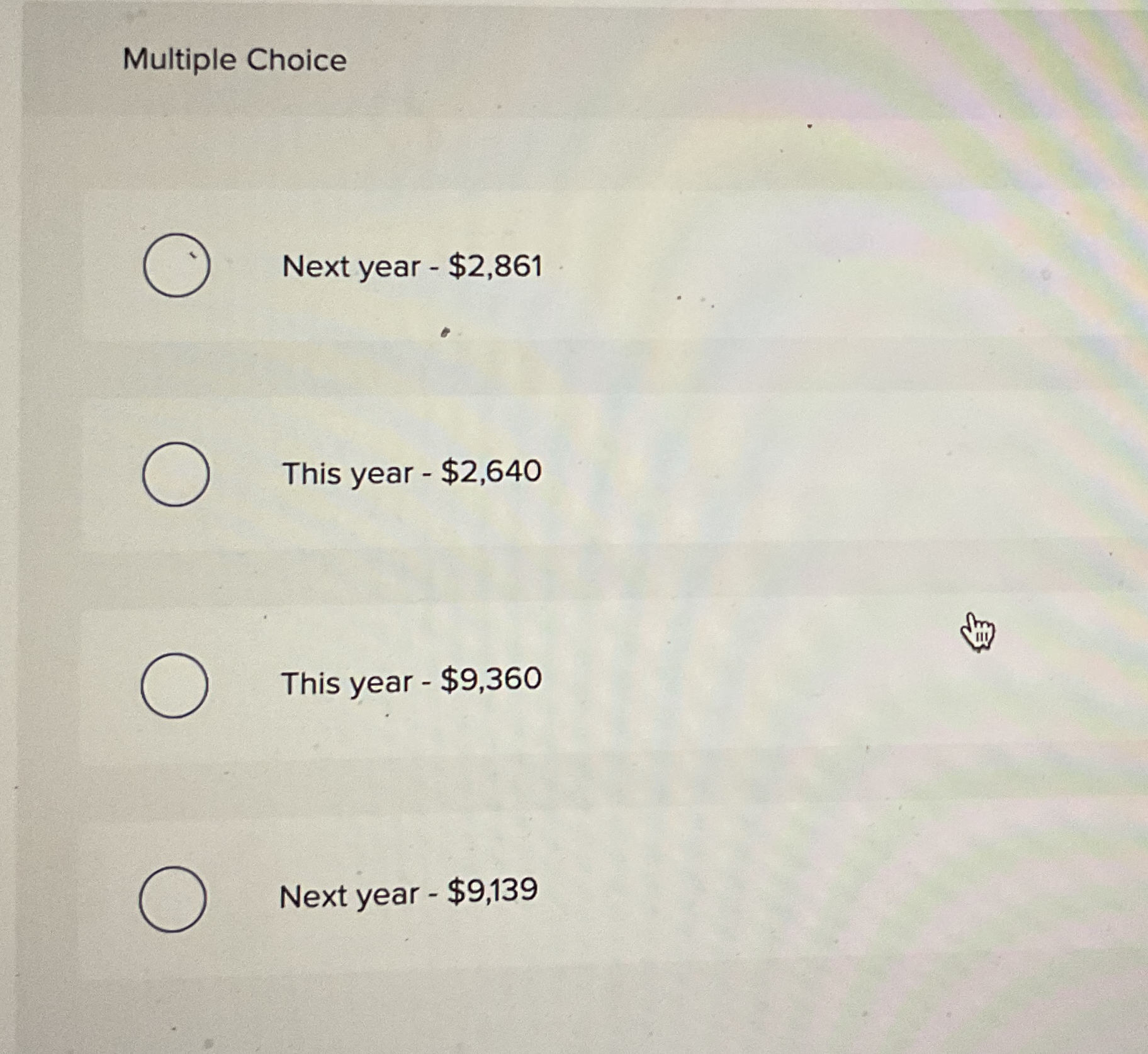

Multiple Choice

Next year $

This year $

This year $

Next year $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock