Question: Mark and Todd agree that the ratio analysis can provide a measure of the companys performance. They have chosen Boeing as an aspirant company. Would

-

Mark and Todd agree that the ratio analysis can provide a measure of the companys performance. They have chosen Boeing as an aspirant company. Would you choose Boeing as an aspirant company? Why or why not? There are other aircraft manufacturers S&S Air could use as an aspirant companies. Discuss whether it is appropriate to use any of the following companies: Bombardier, Embraer, Cirrus Aircraft Corporation, and Cessna Aircraft Company.

Mark and Todd agree that the ratio analysis can provide a measure of the companys performance. They have chosen Boeing as an aspirant company. Would you choose Boeing as an aspirant company? Why or why not? There are other aircraft manufacturers S&S Air could use as an aspirant companies. Discuss whether it is appropriate to use any of the following companies: Bombardier, Embraer, Cirrus Aircraft Corporation, and Cessna Aircraft Company.

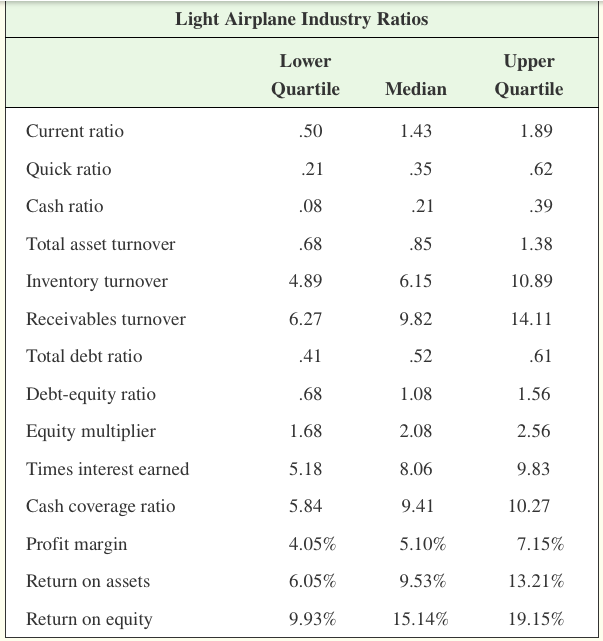

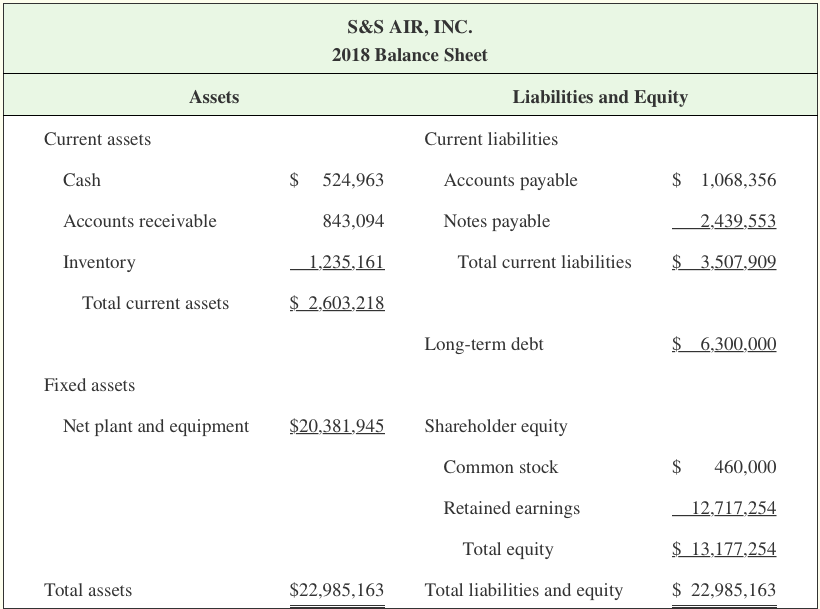

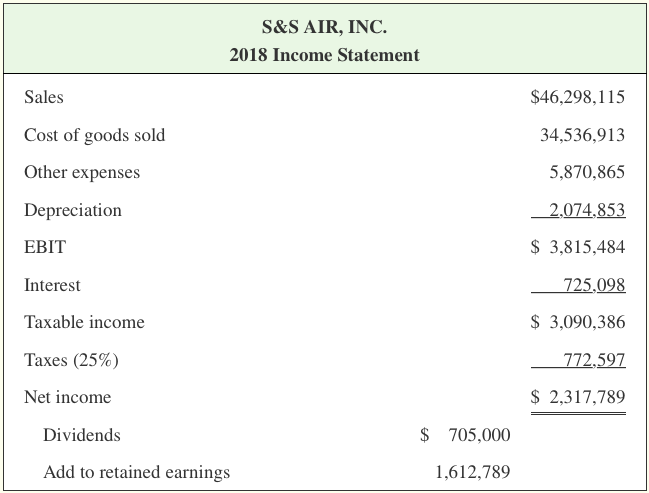

Light Airplane Industry Ratios Lower Quartile Upper Quartile Current ratio 1.43 .35 1.89 .62 Quick ratio Cash ratio Total asset turnover 1.38 Inventory turnover 4.89 6.15 10.89 Receivables turnover 6.27 9.82 14.11 Total debt ratio .52 .61 Debt-equity ratio .68 1.08 1.56 2.56 Equity multiplier 1.68 2.08 Times interest earned 5.18 8.06 9.83 Cash coverage ratio 5.84 9.41 10.27 Profit margin 4.05% 5.10% 7.15% Return on assets 6.05% 9.53% 13.21% Return on equity 9.93% 15.14% 19.15% S&S AIR, INC. 2018 Balance Sheet Assets Liabilities and Equity Current assets Current liabilities Cash $ 524,963 Accounts payable $ 1,068,356 Accounts receivable 843,094 Notes payable 2,439,553 $ 3,507,909 Inventory Total current liabilities 1,235,161 $ 2,603,218 Total current assets Long-term debt $ 6,300,000 Fixed assets Net plant and equipment $20,381,945 Shareholder equity Common stock $ 460,000 Retained earnings 12,717,254 $ 13,177,254 Total equity Total assets $22,985,163 Total liabilities and equity $ 22,985,163 S&S AIR, INC. 2018 Income Statement Sales $46,298,115 Cost of goods sold 34,536,913 5,870,865 Other expenses Depreciation 2,074,853 EBIT $ 3,815,484 Interest 725,098 Taxable income $ 3,090,386 Taxes (25%) 772.597 Net income $ 2,317,789 Dividends $ 705,000 Add to retained earnings 1,612,789

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts