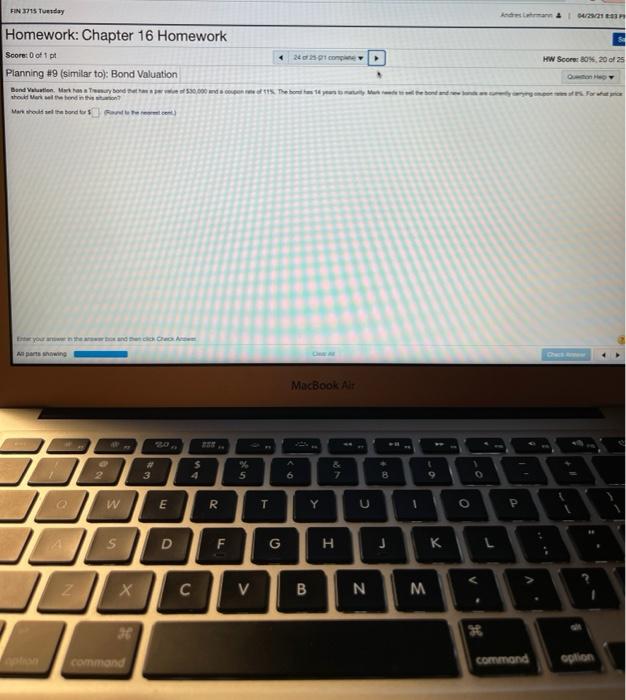

Question: Mark has a Treasury bond that has a par value of $30,000 and a coupon rate of 11%. The bond has 14 years to maturity.

FIN 1715 Tuesday de 14/2013 Homework: Chapter 16 Homework Score: of 1 pt 240 come HW Score: 80%, 20 of 25 Planning #9 (similar to): Bond Valuation Bundation Temur Bord 50.000 de The hou shoulder to Forte Marshall border- youth Anawang MacBook Air # 3 s 4 2 5 6 7 B w E R T Y U s D F G H J / V B N M command Command option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts