Question: Mark has been working on an advanced technology in laser eye surgery. His technology will be available in the near term. He anticipates his first

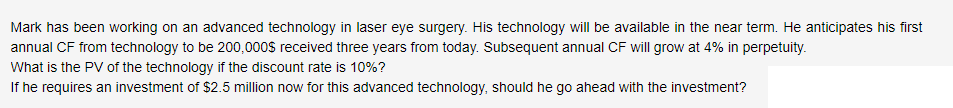

Mark has been working on an advanced technology in laser eye surgery. His technology will be available in the near term. He anticipates his first annual CF from technology to be 200,000$ received three years from today. Subsequent annual CF will grow at 4% in perpetuity. What is the PV of the technology if the discount rate is 10%? If he requires an investment of $2.5 million now for this advanced technology, should he go ahead with the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts