Question: Mark informs you that the firm always seeks to maintain moderately aggressive portfolios. You are expected to solve for the weights that are to be

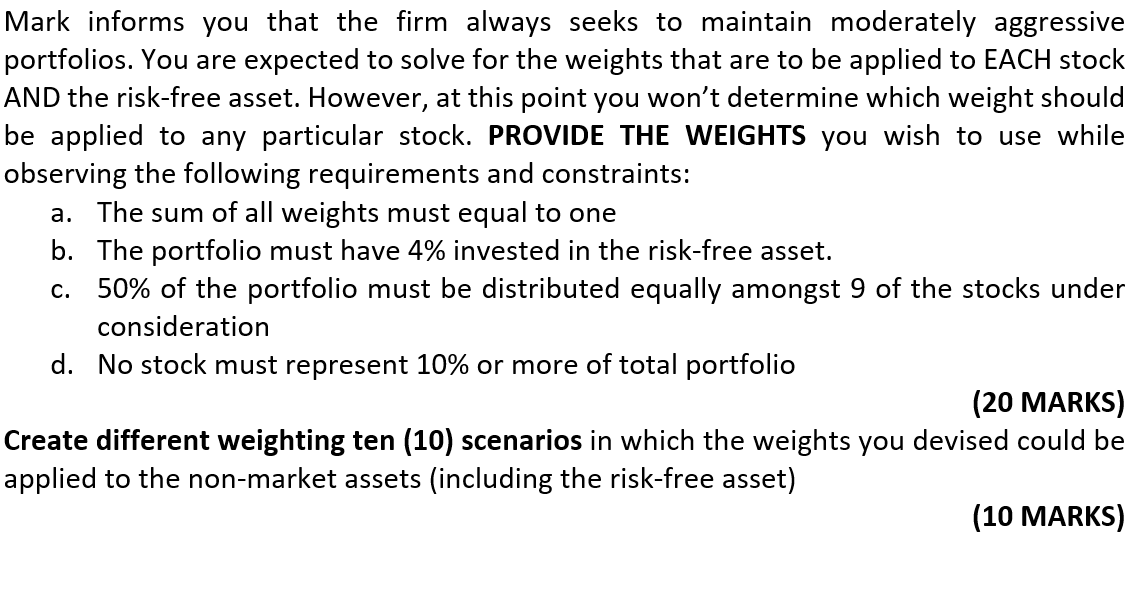

Mark informs you that the firm always seeks to maintain moderately aggressive portfolios. You are expected to solve for the weights that are to be applied to EACH stock AND the risk-free asset. However, at this point you won't determine which weight should be applied to any particular stock. PROVIDE THE WEIGHTS you wish to use while observing the following requirements and constraints: a. The sum of all weights must equal to one b. The portfolio must have 4% invested in the risk-free asset. 50% of the portfolio must be distributed equally amongst 9 of the stocks under consideration d. No stock must represent 10% or more of total portfolio (20 MARKS) Create different weighting ten (10) scenarios in which the weights you devised could be applied to the non-market assets (including the risk-free asset) (10 MARKS) C. Mark informs you that the firm always seeks to maintain moderately aggressive portfolios. You are expected to solve for the weights that are to be applied to EACH stock AND the risk-free asset. However, at this point you won't determine which weight should be applied to any particular stock. PROVIDE THE WEIGHTS you wish to use while observing the following requirements and constraints: a. The sum of all weights must equal to one b. The portfolio must have 4% invested in the risk-free asset. 50% of the portfolio must be distributed equally amongst 9 of the stocks under consideration d. No stock must represent 10% or more of total portfolio (20 MARKS) Create different weighting ten (10) scenarios in which the weights you devised could be applied to the non-market assets (including the risk-free asset) (10 MARKS) C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts