Question: Mark received 10 ISOs at the time he started working for Hendricks Corporation five years ago, when Hendricks's price was $5 per share (each option

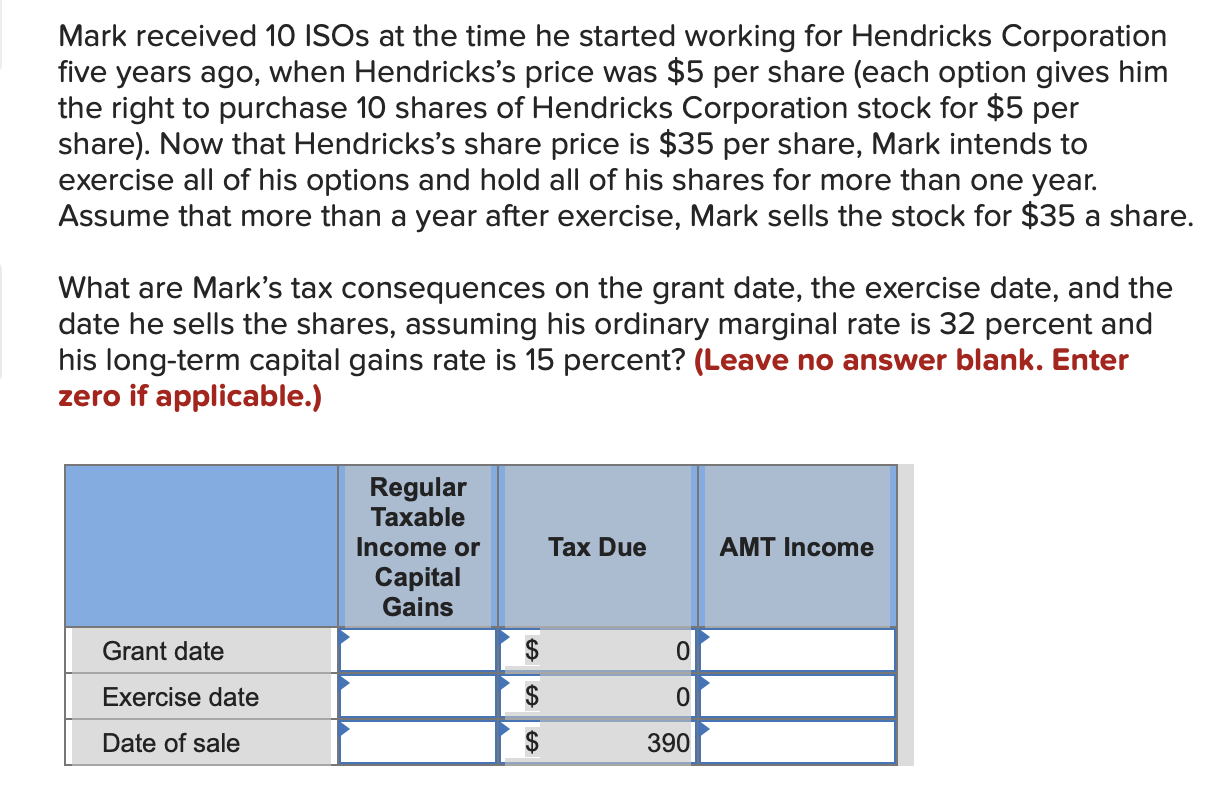

Mark received 10 ISOs at the time he started working for Hendricks Corporation five years ago, when Hendricks's price was $5 per share (each option gives him the right to purchase 10 shares of Hendricks Corporation stock for $5 per share). Now that Hendricks's share price is $35 per share, Mark intends to exercise all of his options and hold all of his shares for more than one year. Assume that more than a year after exercise, Mark sells the stock for $35 a share. What are Mark's tax consequences on the grant date, the exercise date, and the date he sells the shares, assuming his ordinary marginal rate is 32 percent and his long-term capital gains rate is 15 percent? (Leave no answer blank. Enter zero if applicable.) Regular Taxable Income or Capital Gains Tax Due AMT Income Grant date O O Exercise date $ Date of sale 390

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts