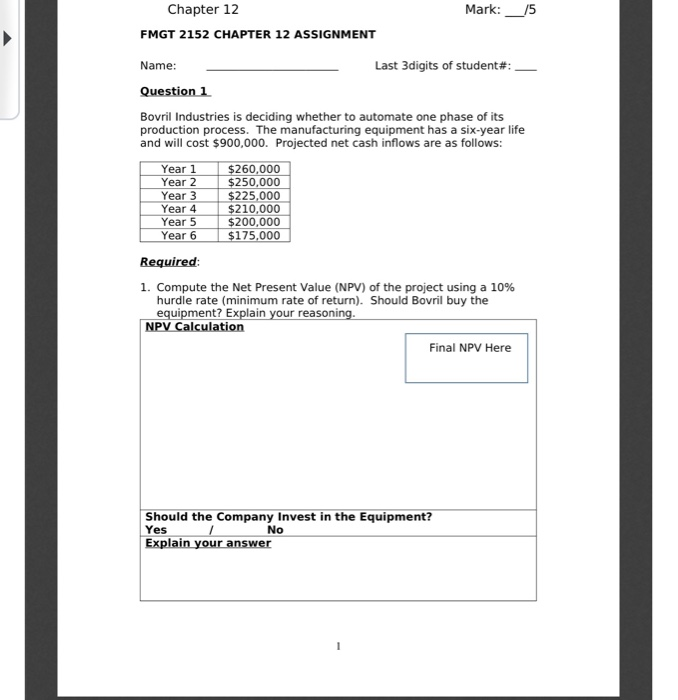

Question: Mark:__/5 Chapter 12 FMGT 2152 CHAPTER 12 ASSIGNMENT Name: Last 3digits of student#: Question 1 Bovril Industries is deciding whether to automate one phase of

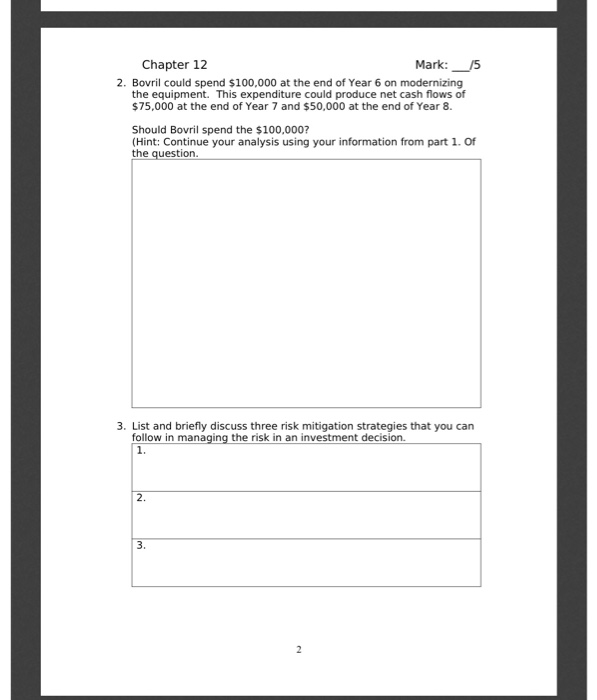

Mark:__/5 Chapter 12 FMGT 2152 CHAPTER 12 ASSIGNMENT Name: Last 3digits of student#: Question 1 Bovril Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $900,000. Projected net cash inflows are as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $260,000 $250,000 $225,000 $210,000 $200,000 $175,000 Required 1. Compute the Net Present Value (NPV) of the project using a 10% hurdle rate (minimum rate of return). Should Bovril buy the equipment? Explain your reasoning. NPV Calculation Final NPV Here Should the Company Invest in the Equipment? Yes No Explain your answer Chapter 12 Mark: /5 2. Bovril could spend $100,000 at the end of Year 6 on modernizing the equipment. This expenditure could produce net cash flows of $75,000 at the end of Year 7 and $50,000 at the end of Year 8. Should Bovril spend the $100,000? (Hint: Continue your analysis using your information from part 1. Of the question. 3. List and briefly discuss three risk mitigation strategies that you can follow in managing the risk in an investment decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts