Question: Marketable Debt Securities Use the financial statement effects template to record the accounts and amounts for the following four transactions involving investments in marketable

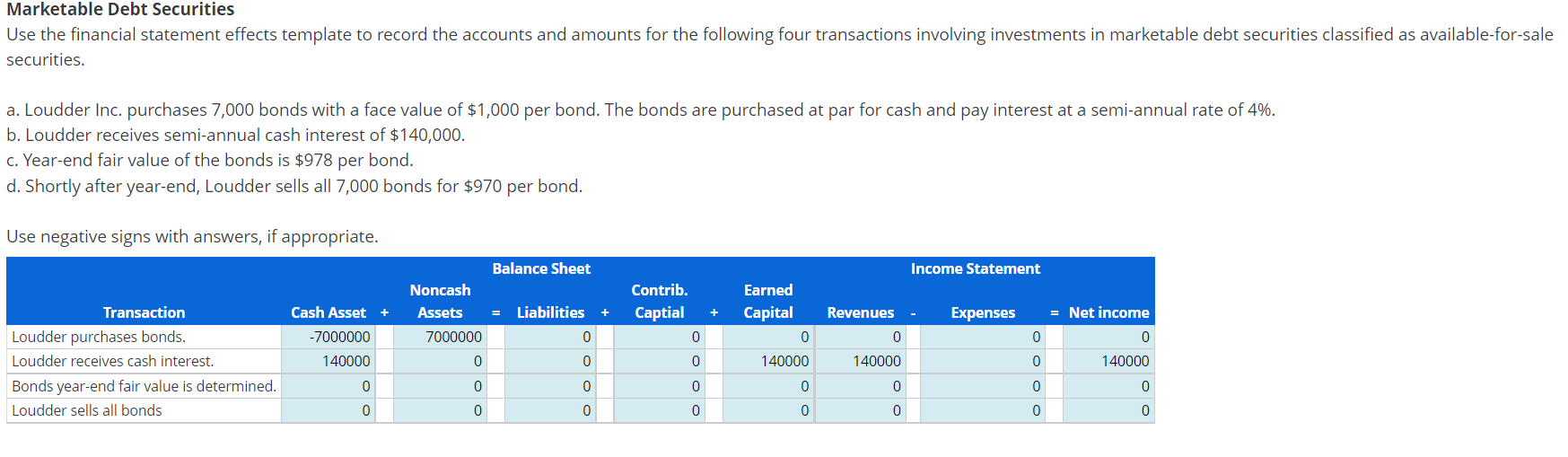

Marketable Debt Securities Use the financial statement effects template to record the accounts and amounts for the following four transactions involving investments in marketable debt securities classified as available-for-sale securities. a. Loudder Inc. purchases 7,000 bonds with a face value of $1,000 per bond. The bonds are purchased at par for cash and pay interest at a semi-annual rate of 4%. b. Loudder receives semi-annual cash interest of $140,000. c. Year-end fair value of the bonds is $978 per bond. d. Shortly after year-end, Loudder sells all 7,000 bonds for $970 per bond. Use negative signs with answers, if appropriate. Transaction Loudder purchases bonds. Loudder receives cash interest. Bonds year-end fair value is determined. Loudder sells all bonds Cash Asset + -7000000 140000 0 0 Noncash Assets 7000000 0 OOO 0 0 Balance Sheet Contrib. = Liabilities + Captial 0 0 0 0 + Earned Capital 0 140000 0 0 Revenues - 0 140000 0 Income Statement 0 Expenses = Net income 0 oooo 0 0 0 140000 0 0

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts