Question: Markowitz's portfolio optimization In this project, you will learn how to implement Markowitz's portfolio optimization with real-world datasets. You can use any programming language. (a)

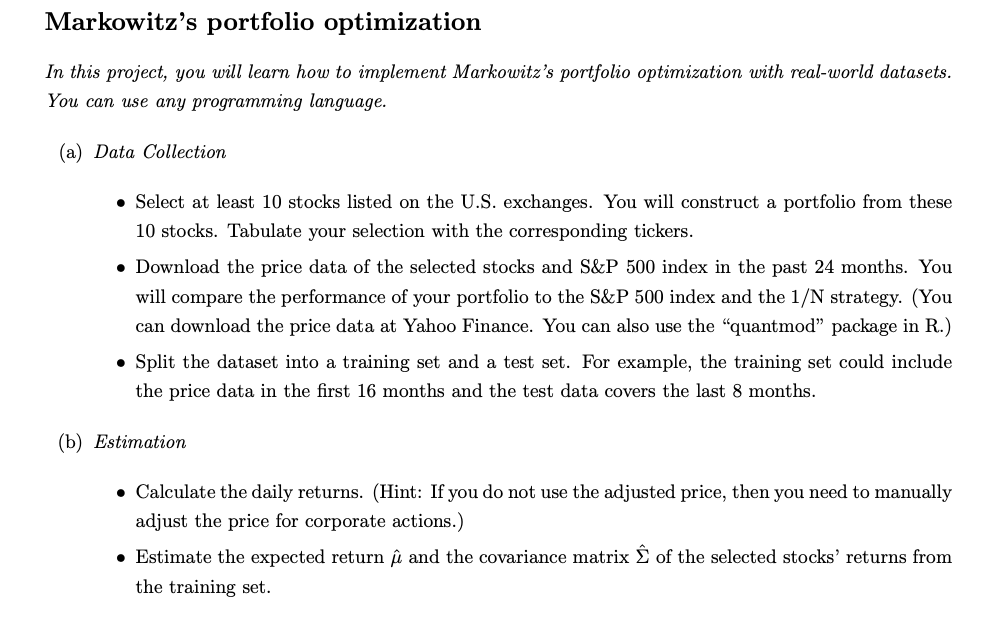

Markowitz's portfolio optimization In this project, you will learn how to implement Markowitz's portfolio optimization with real-world datasets. You can use any programming language. (a) Data Collection Select at least 10 stocks listed on the U.S. exchanges. You will construct a portfolio from these 10 stocks. Tabulate your selection with the corresponding tickers. Download the price data of the selected stocks and S&P 500 index in the past 24 months. You will compare the performance of your portfolio to the S&P 500 index and the 1/N strategy. (You can download the price data at Yahoo Finance. You can also use the "quantmod" package in R.) Split the dataset into a training set and a test set. For example, the training set could include the price data in the first 16 months and the test data covers the last 8 months. (b) Estimation Calculate the daily returns. (Hint: If you do not use the adjusted price, then you need to manually adjust the price for corporate actions.) Estimate the expected return and the covariance matrix of the selected stocks' returns from the training set. Markowitz's portfolio optimization In this project, you will learn how to implement Markowitz's portfolio optimization with real-world datasets. You can use any programming language. (a) Data Collection Select at least 10 stocks listed on the U.S. exchanges. You will construct a portfolio from these 10 stocks. Tabulate your selection with the corresponding tickers. Download the price data of the selected stocks and S&P 500 index in the past 24 months. You will compare the performance of your portfolio to the S&P 500 index and the 1/N strategy. (You can download the price data at Yahoo Finance. You can also use the "quantmod" package in R.) Split the dataset into a training set and a test set. For example, the training set could include the price data in the first 16 months and the test data covers the last 8 months. (b) Estimation Calculate the daily returns. (Hint: If you do not use the adjusted price, then you need to manually adjust the price for corporate actions.) Estimate the expected return and the covariance matrix of the selected stocks' returns from the training set

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts