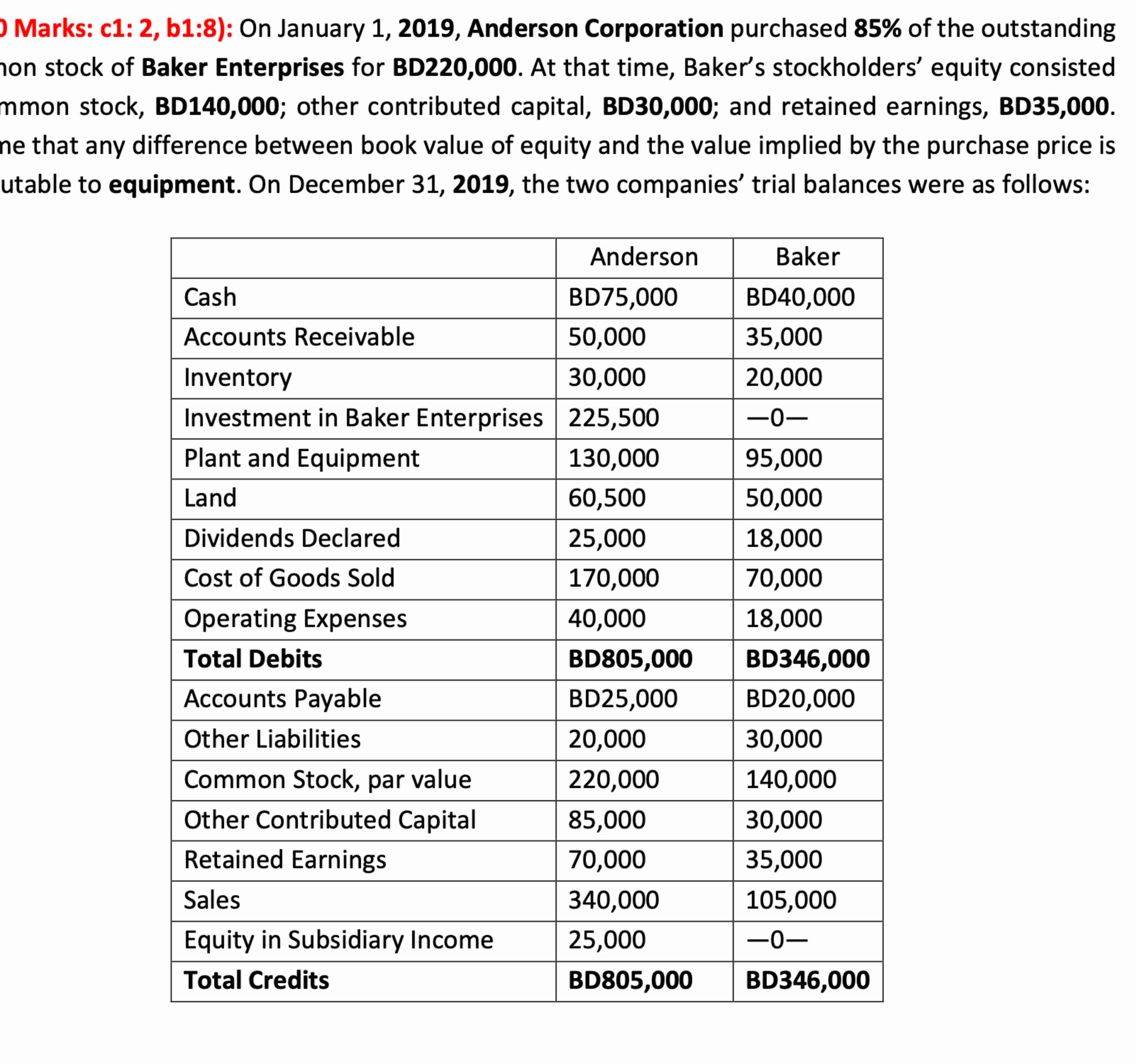

Question: Marks: c 1 : 2 , b 1 : 8 ) : On January 1 , 2 0 1 9 , Anderson Corporation purchased 8

Marks: c: b:: On January Anderson Corporation purchased of the outstanding hon stock of Baker Enterprises for BD At that time, Baker's stockholders' equity consisted mmon stock, BD; other contributed capital, BD; and retained earnings, BD ne that any difference between book value of equity and the value implied by the purchase price is utable to equipment. On December the two companies' trial balances were as follows: Anderson Baker Cash BD BD Accounts Receivable Inventory Investment in Baker Enterprises Plant and Equipment Land Dividends Declared Cost of Goods Sold Operating Expenses Total Debits BD BD Accounts Payable BD BD Other Liabilities Common Stock, par value Other Contributed Capital Retained Earnings Sales Equity in Subsidiary Income Total Credits BD BD I want u to help me solve these questions based on the trial balances I gave u A Computation and Allocation of Difference Between Implied and Book Value Acquired. Marks BPrepare a consolidated statements workpaper on December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock