Question: On November 1, 19, Ken Ryan organized Continental Moving Company. The transactions occurring during the first month of operations were as follows: Nov. 1

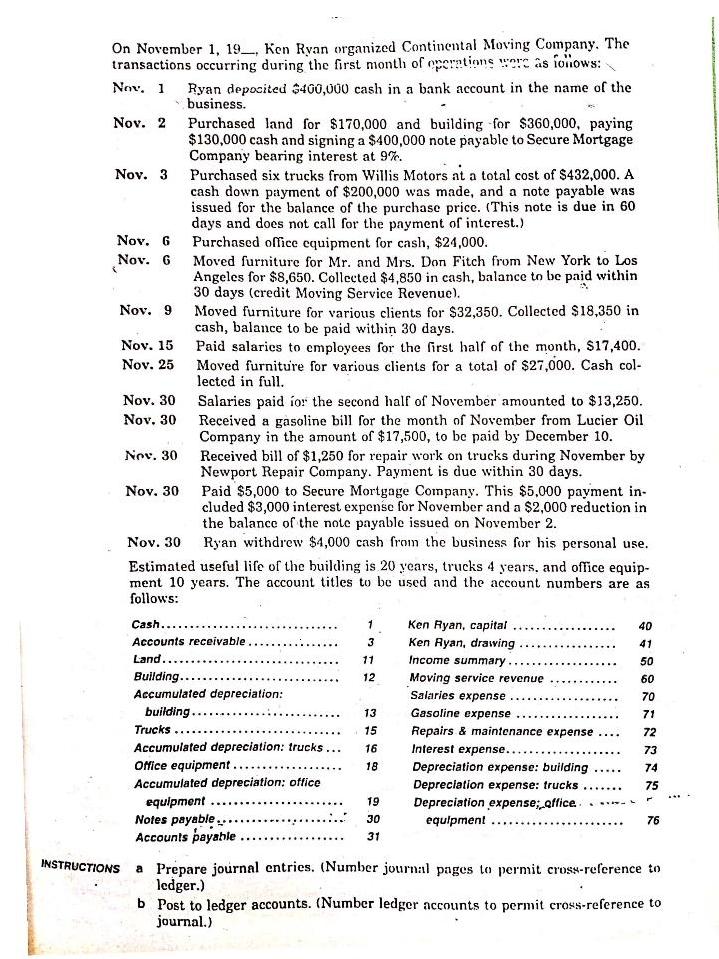

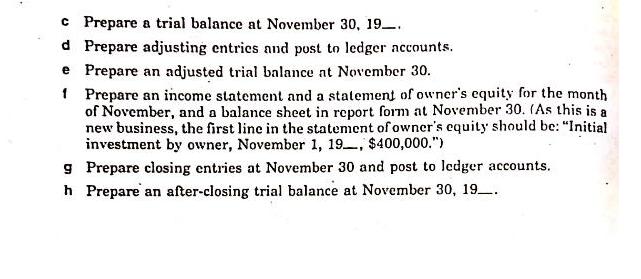

On November 1, 19, Ken Ryan organized Continental Moving Company. The transactions occurring during the first month of operations were as follows: Nov. 1 Nov. 2 Nov. 3 Nov. 6 Nov. 6 { Nov. 9 Nov. 15 Nov. 25 INSTRUCTIONS Nov. 30 Nov. 30 Nov. 30 Ryan depocited $400,000 cash in a bank account in the name of the business. Purchased land for $170,000 and building for $360,000, paying $130,000 cash and signing a $400,000 note payable to Secure Mortgage Company bearing interest at 9%. Nov. 30 Purchased six trucks from Willis Motors at a total cost of $432,000. A cash down payment of $200,000 was made, and a note payable was issued for the balance of the purchase price. (This note is due in 60 days and does not call for the payment of interest.) Purchased office equipment for cash, $24,000. Moved furniture for Mr. and Mrs. Don Fitch from New York to Los Angeles for $8,650. Collected $4,850 in cash, balance to be paid within 30 days (credit Moving Service Revenue). Moved furniture for various clients for $32,350. Collected $18,350 in cash, balance to be paid within 30 days. Paid salaries to employees for the first half of the month, $17,400. Moved furniture for various clients for a total of $27,000. Cash col- lected in full. Salaries paid for the second half of November amounted to $13,250. Received a gasoline bill for the month of November from Lucier Oil Company in the amount of $17,500, to be paid by December 10. Received bill of $1,250 for repair work on trucks during November by Newport Repair Company. Payment is due within 30 days. Paid $5,000 to Secure Mortgage Company. This $5,000 payment in- cluded $3,000 interest expense for November and a $2,000 reduction in the balance of the note payable issued on November 2. Nov. 30 Ryan withdrew $4,000 cash from the business for his personal use. Estimated useful life of the building is 20 years, trucks 4 years, and office equip- ment 10 years. The account titles to be used and the account numbers are as follows: Cash....... Accounts receivable. Land.. Building.... Accumulated depreciation: building.... ***** Trucks Accumulated depreciation: trucks... Office equipment.. ******** Accumulated depreciation: office equipment ***** Notes payable... Accounts payable 1 3 11 12 13 15 15 16 18 19 30 31 Ken Ryan, capital Ken Ryan, drawing Income summary.. Moving service revenue Salaries expense.... Gasoline expense Repairs & maintenance expense... Interest expense......... Depreciation expense: building Depreciation expense: trucks Depreciation expense; office.. equipment ********* ******* L 40 41 50 60 70 71 72 73 74 75 F 76 a Prepare journal entries. (Number journal pages to permit cross-reference to ledger.) b Post to ledger accounts. (Number ledger accounts to permit cross-reference to journal.) *** c Prepare a trial balance at November 30, 19. d Prepare adjusting entries and post to ledger accounts. e Prepare an adjusted trial balance at November 30. 1 Prepare an income statement and a statement of owner's equity for the month of November, and a balance sheet in report form at November 30. (As this is a new business, the first line in the statement of owner's equity should be: "Initial investment by owner, November 1, 19, $400,000.") Prepare closing entries at November 30 and post to ledger accounts. 9 h Prepare an after-closing trial balance at November 30, 19. On November 1, 19, Ken Ryan organized Continental Moving Company. The transactions occurring during the first month of operations were as follows: Nov. 1 Nov. 2 Nov. 3 Nov. 6 Nov. 6 { Nov. 9 Nov. 15 Nov. 25 INSTRUCTIONS Nov. 30 Nov. 30 Nov. 30 Ryan depocited $400,000 cash in a bank account in the name of the business. Purchased land for $170,000 and building for $360,000, paying $130,000 cash and signing a $400,000 note payable to Secure Mortgage Company bearing interest at 9%. Nov. 30 Purchased six trucks from Willis Motors at a total cost of $432,000. A cash down payment of $200,000 was made, and a note payable was issued for the balance of the purchase price. (This note is due in 60 days and does not call for the payment of interest.) Purchased office equipment for cash, $24,000. Moved furniture for Mr. and Mrs. Don Fitch from New York to Los Angeles for $8,650. Collected $4,850 in cash, balance to be paid within 30 days (credit Moving Service Revenue). Moved furniture for various clients for $32,350. Collected $18,350 in cash, balance to be paid within 30 days. Paid salaries to employees for the first half of the month, $17,400. Moved furniture for various clients for a total of $27,000. Cash col- lected in full. Salaries paid for the second half of November amounted to $13,250. Received a gasoline bill for the month of November from Lucier Oil Company in the amount of $17,500, to be paid by December 10. Received bill of $1,250 for repair work on trucks during November by Newport Repair Company. Payment is due within 30 days. Paid $5,000 to Secure Mortgage Company. This $5,000 payment in- cluded $3,000 interest expense for November and a $2,000 reduction in the balance of the note payable issued on November 2. Nov. 30 Ryan withdrew $4,000 cash from the business for his personal use. Estimated useful life of the building is 20 years, trucks 4 years, and office equip- ment 10 years. The account titles to be used and the account numbers are as follows: Cash....... Accounts receivable. Land.. Building.... Accumulated depreciation: building.... ***** Trucks Accumulated depreciation: trucks... Office equipment.. ******** Accumulated depreciation: office equipment ***** Notes payable... Accounts payable 1 3 11 12 13 15 15 16 18 19 30 31 Ken Ryan, capital Ken Ryan, drawing Income summary.. Moving service revenue Salaries expense.... Gasoline expense Repairs & maintenance expense... Interest expense......... Depreciation expense: building Depreciation expense: trucks Depreciation expense; office.. equipment ********* ******* L 40 41 50 60 70 71 72 73 74 75 F 76 a Prepare journal entries. (Number journal pages to permit cross-reference to ledger.) b Post to ledger accounts. (Number ledger accounts to permit cross-reference to journal.) *** c Prepare a trial balance at November 30, 19. d Prepare adjusting entries and post to ledger accounts. e Prepare an adjusted trial balance at November 30. 1 Prepare an income statement and a statement of owner's equity for the month of November, and a balance sheet in report form at November 30. (As this is a new business, the first line in the statement of owner's equity should be: "Initial investment by owner, November 1, 19, $400,000.") Prepare closing entries at November 30 and post to ledger accounts. 9 h Prepare an after-closing trial balance at November 30, 19.

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts