#) Marks) Fred is building his stock portfolio. He's trying to determine which investment to add...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

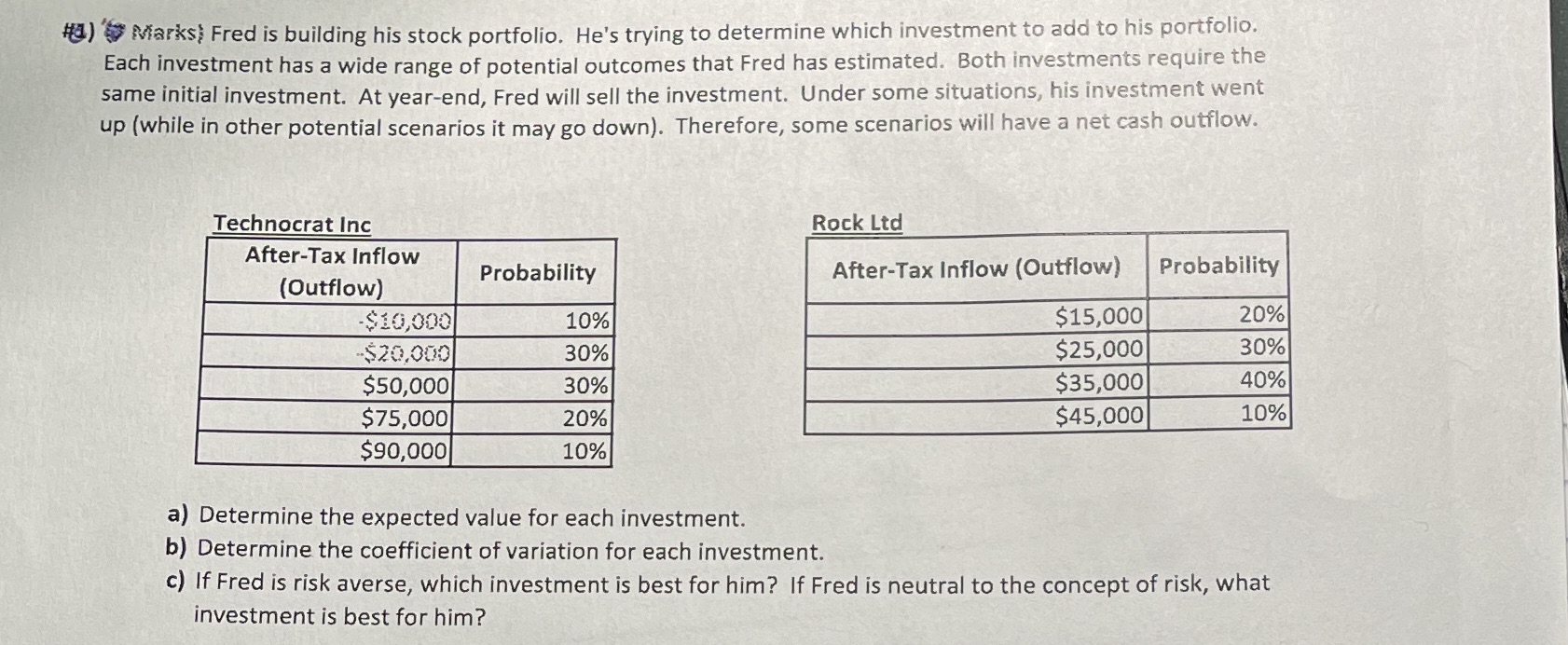

#) Marks) Fred is building his stock portfolio. He's trying to determine which investment to add to his portfolio. Each investment has a wide range of potential outcomes that Fred has estimated. Both investments require the same initial investment. At year-end, Fred will sell the investment. Under some situations, his investment went up (while in other potential scenarios it may go down). Therefore, some scenarios will have a net cash outflow. Technocrat Inc After-Tax Inflow Probability (Outflow) $10,000 10% -$20,000 30% $50,000 30% $75,000 20% $90,000 10% Rock Ltd After-Tax Inflow (Outflow) Probability $15,000 20% $25,000 30% $35,000 40% $45,000 10% a) Determine the expected value for each investment. b) Determine the coefficient of variation for each investment. c) If Fred is risk averse, which investment is best for him? If Fred is neutral to the concept of risk, what investment is best for him? #) Marks) Fred is building his stock portfolio. He's trying to determine which investment to add to his portfolio. Each investment has a wide range of potential outcomes that Fred has estimated. Both investments require the same initial investment. At year-end, Fred will sell the investment. Under some situations, his investment went up (while in other potential scenarios it may go down). Therefore, some scenarios will have a net cash outflow. Technocrat Inc After-Tax Inflow Probability (Outflow) $10,000 10% -$20,000 30% $50,000 30% $75,000 20% $90,000 10% Rock Ltd After-Tax Inflow (Outflow) Probability $15,000 20% $25,000 30% $35,000 40% $45,000 10% a) Determine the expected value for each investment. b) Determine the coefficient of variation for each investment. c) If Fred is risk averse, which investment is best for him? If Fred is neutral to the concept of risk, what investment is best for him?

Expert Answer:

Posted Date:

Students also viewed these finance questions

-

respond to the instruction using the following criteria: Individual Written Case Exercise Respond to the specific questions provide in the case document it will be seven documents. Please make sure...

-

Subject : Strategic Management in a Global Environment Safaricom: Innovative Telecom Solutions to Empower Kenyans As the largest mobile provider in Kenya, Safaricom has touched the lives of Kenyans...

-

In Australia, the banking sector is dominated by four main institutions, the ANZ Banking Group, Commonwealth Bank, National Australia Bank, and Westpac. To maintain a competitive banking market, the...

-

Describe what a purchasing company might want to learn from a vendor demonstration of a packaged system.

-

Indicate how you intend to capture and sustain a healthcare service nicheand justify your preferred competitive service strategy.

-

On March 15, 2020, Stink Inc. issued $946 in principal of five-year zero coupon bonds on July 1, 2020. The company sold the bonds at a $193 discount to par. HOW much interest expense will stink...

-

Problems 2.1. Is the statement "The U.S. has 1,300,000 tons of uranium resources" complete? 2.2. Figure 2.16 shows the discovery rate of U308, per foot drilled, in a certain price range. Based on...

-

(d) A 12" OD steel subsea export line is to be laid between two offshore production platforms. The seabed consists of gravel and sand. There are no physical obstructions on the pipelay route but...

-

7. The force F on the piston in Figure 5 causes the link AB to exert a force P = 2 kN on the pin B in Figure 5. Find the moment of this force about C for the case where the distance d = 70 mm and the...

-

You have been asked to calculate some performance characteristics of a new solar collector on the market. You have some of the details for it as shown below. a) Compute the effective transmittance...

-

In an orthonormal, right-handed reference system, the components of the Cauchy stress tensor at a point Q are: Determine: [57 0 24] 0 50 0 24 0 43 1. The principal stresses and principal directions...

Study smarter with the SolutionInn App