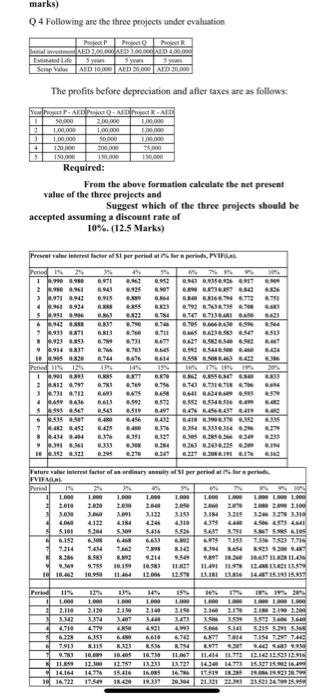

Question: marks) Q4 Following are the three projects under evaluation Project AED 2.00.00 AED 3,00,000 AED 400,000 Estimated Life years Scrap Vale AED 1,000 AED 20,000

marks) Q4 Following are the three projects under evaluation Project AED 2.00.00 AED 3,00,000 AED 400,000 Estimated Life years Scrap Vale AED 1,000 AED 20,000 AED 20.000 The profits before depreciation and after taxes are as follows: Yoad Project P-AEE Project - A Project RARE 1 2.00.000 1,00,000 100 000 100 000 1,00,000 1 100.000 SO 120,000 150.000 1.30,000 Required: From the above formation calculate the net present value of the three projects and Suggest which of the three projects should be accepted assuming a discount rate of 10%. (12.5 Marks) Presentate interest factor of S1 per period is for a periods, PVIFA 6.971 4.925 SES 188,36 17 89 TBS 0.915 BU 0.93 0.732.738 0.0 0.713. 0.705 . . 0.6 0.623.583 65 . . 1 2.90 0.961 3.971 0.93 40.961 4.924 $ 0.00 6 1.943 . 7 933 0811 8 1.923 0.853 ..914 0.37 10.905 0820 Periods 1 0.901 0.893 3.812 0.717 3.731 2.712 459 46 4.931 0.744 676 BEN 4.877 . 4.675 18% 17% 1995 0.82 58 10 TI. 6 64.53 0.562 05146.56 . 0.42 35 8.410 390N 0.1 144 6 5 0.51 7.43 0.453 1.434 0.44 9 1 0.361 10.393 3333 3 0.23 0.30.1.209 395 Puture value interest factor of serdinary anity of per periods for periode FIFMA Pried LA LA L000 21 2010 20 2.0 2.100 3123 IN 26 27 40 346 10 4 4.513 L 5.10 5.04 5.416 5 S SANS GIOS 6.152 6975 7 7214 9414 RI 16 TU 11491 11.5 12.5 13.57 10 10.463 10.00 12.06 13.1 13.816 HT1931S 125 Period 11 18 19 20 000 1.000 1.000 2120 UM 1779 21 2.407 159 1.000 219 14473 1990 50 2013 1 4921 2014 2154 72 74 7911 SIIS 8.977 11.09 16 10.7 113 16. 12 100 IL 14.164 116722 12.799 15.416 18.400 16.76 1532752164 17.519 1825 1826 182.9232014 21.321 222083 23.62124715.959

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts