Question: Markum Enterprises is considering permanently adding an additional $182 million of debt to its capital structure. Markum's corporate tax rate is 30%. a. Absent personal

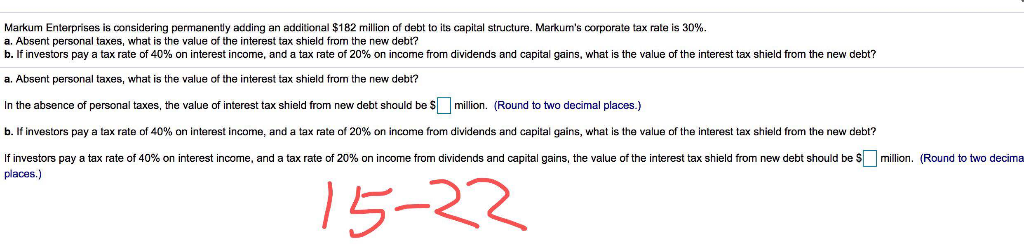

Markum Enterprises is considering permanently adding an additional $182 million of debt to its capital structure. Markum's corporate tax rate is 30%. a. Absent personal taxes, what is the value of the interest tax shield from the new debt? b. If investors pay a tax rate o 40% on interest income, and a tax rate of 20% on income from dividends and capital gains, what is he value o the interest tax shield from the new debt? a. Absent personal taxes, what is the value of the interest tax shield from the new debt? In the absence of personal taxes, the value of interest tax shield from new debt should be S million. (Round to two decimal places.) b t investors pay a tax rate o 40% on interest income, and a tax rate of 20 % on income from dividends and cap al gains hat is tha valu a o then e es ax sied om enew det? lf investors pay a ax rate o 40% on interest income, and a tax rte of 20 places.) on income from dividends and capital gains, the value of the interest tax shield rom new debt should be Round o t o decima mil on 15-22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts