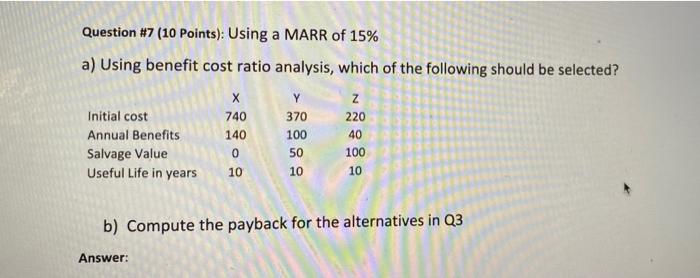

Question: MARR = 5% for Q3 Question #7 (10 Points): Using a MARR of 15% a) Using benefit cost ratio analysis, which of the following should

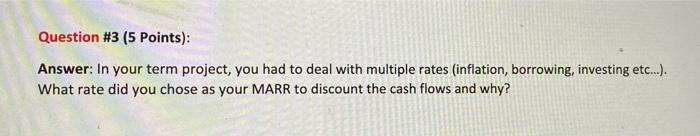

Question #7 (10 Points): Using a MARR of 15% a) Using benefit cost ratio analysis, which of the following should be selected? Y Z Initial cost 740 370 220 Annual Benefits 140 100 Salvage Value 50 100 Useful Life in years 10 10 10 40 0 b) Compute the payback for the alternatives in Q3 Answer: Question #3 (5 Points): Answer: In your term project, you had to deal with multiple rates (inflation, borrowing, investing etc...). What rate did you chose as your MARR to discount the cash flows and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts