Question: Married couples will normally file jointly. Identify a situation where a married couple may prefer to file separately. 1. One spouse has considerably higher income

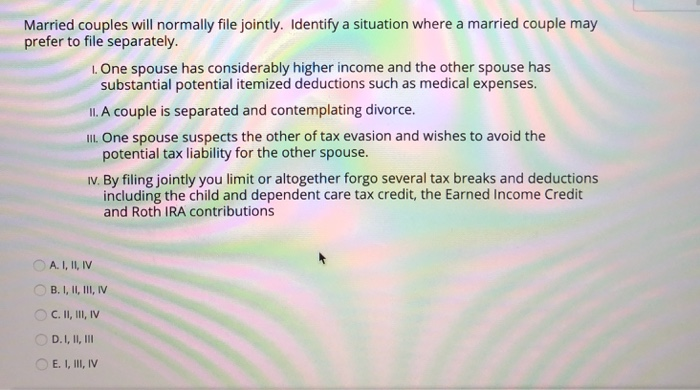

Married couples will normally file jointly. Identify a situation where a married couple may prefer to file separately. 1. One spouse has considerably higher income and the other spouse has substantial potential itemized deductions such as medical expenses. II. A couple is separated and contemplating divorce. III. One spouse suspects the other of tax evasion and wishes to avoid the potential tax liability for the other spouse. IV. By filing jointly you limit or altogether forgo several tax breaks and deductions including the child and dependent care tax credit, the Earned Income Credit and Roth IRA contributions A. I, II, IV B. I, II, III, IV C. II, III, IV D.I, II, III E. I, III, IV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts