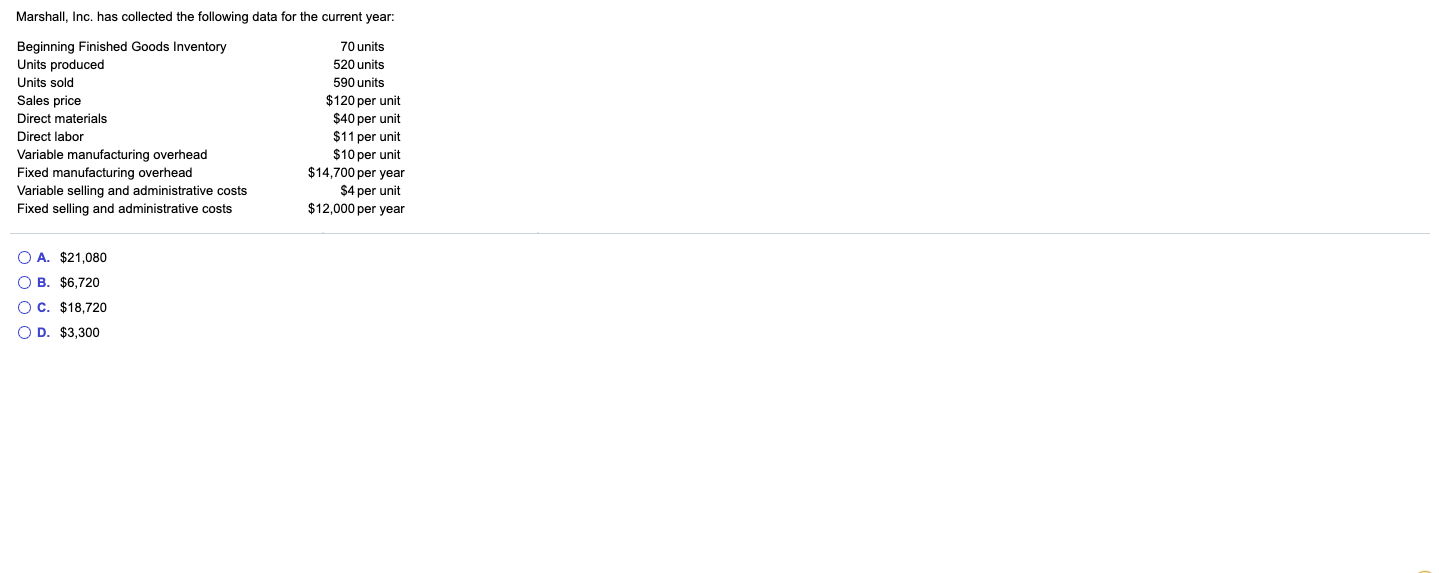

Question: Marshall, Inc. has collected the following data for the current year: Beginning Finished Goods Inventory Units produced Units sold Sales price Direct materials Direct labor

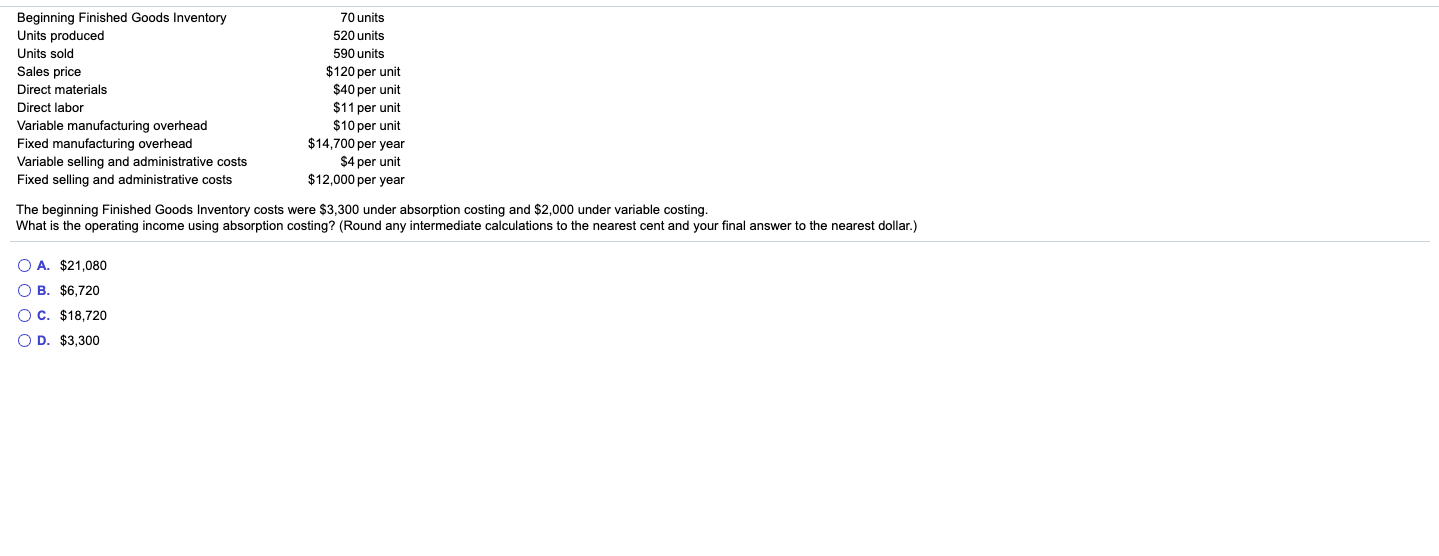

Marshall, Inc. has collected the following data for the current year: Beginning Finished Goods Inventory Units produced Units sold Sales price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative costs Fixed selling and administrative costs 70 units 520 units 590 units $120 per unit $40 per unit $11 per unit $10 per unit $14,700 per year $4 per unit $12,000 per year O A. $21,080 O B. $6,720 O c. $18,720 OD. $3,300 Beginning Finished Goods Inventory Units produced Units sold Sales price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative costs Fixed selling and administrative costs 70 units 520 units 590 units $120 per unit $40 per unit $11 per unit $10 per unit $14,700 per year $4 per unit $12,000 per year The beginning Finished Goods Inventory costs were $3,300 under absorption costing and $2,000 under variable costing. What is the operating income using absorption costing? (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar.) O A. $21,080 OB. $6,720 O c. $18,720 O D. $3,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts