Question: Marston, Inc. has developed a forecasting model to estimate its AFN for the upcoming year. All else being equal, which of the following factors is

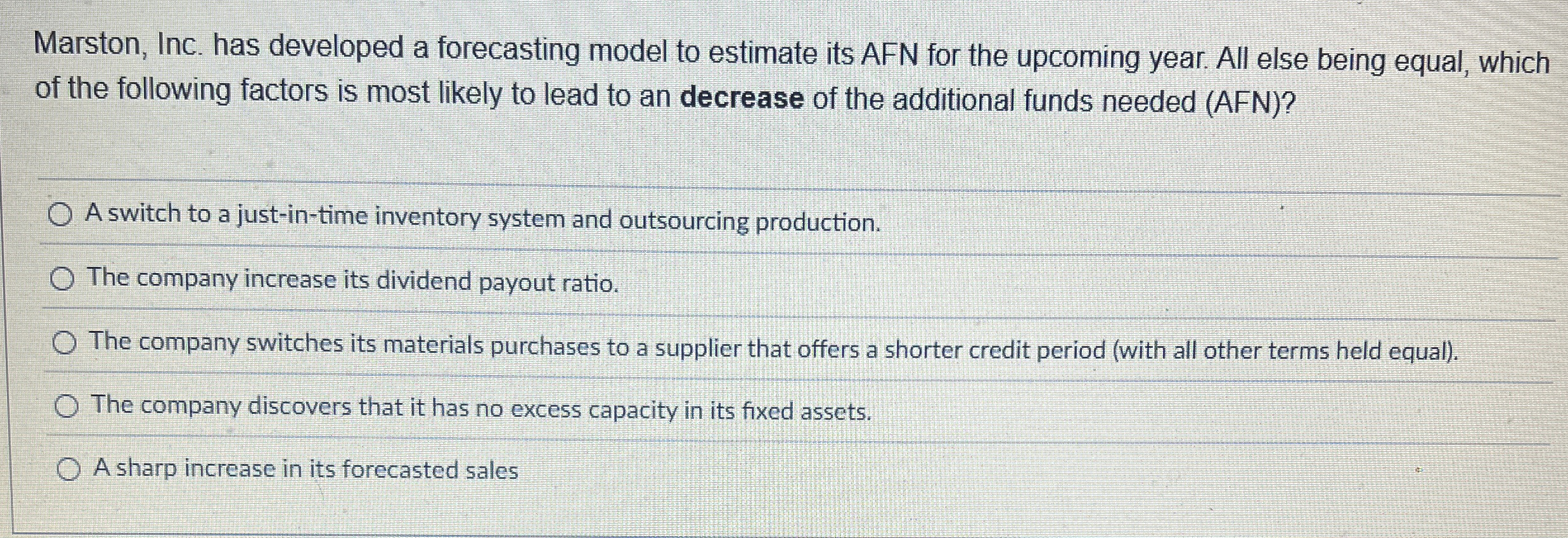

Marston, Inc. has developed a forecasting model to estimate its AFN for the upcoming year. All else being equal, which

of the following factors is most likely to lead to an decrease of the additional funds needed AFN

A switch to a justintime inventory system and outsourcing production.

The company increase its dividend payout ratio.

The company switches its materials purchases to a supplier that offers a shorter credit period with all other terms held equal

The company discovers that it has no excess capacity in its fixed assets.

A sharp increase in its forecasted sales

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock