Question: Martell Mining was doing well the first two years growing at a rate of 20%. But from the beginning of the third year (or at

Martell Mining was doing well the first two years growing at a rate of 20%. But from the beginning of the third year (or at the end of the second year) Martell Mining Company's ore reserves were being depleted, so its sales were falling. Also, its pit was getting deeper each year, so its costs were rising. As a result, the company's earnings and dividends were declining at a constant rate of 5 percent per year, which means it was growing at a negative rate of 5% after the end of the second year. If D0 = $5 and rs=15%, what was the value of Martell Mining's stock P0? A). $39, B). $36.52, C). $32.25, D).$30.55

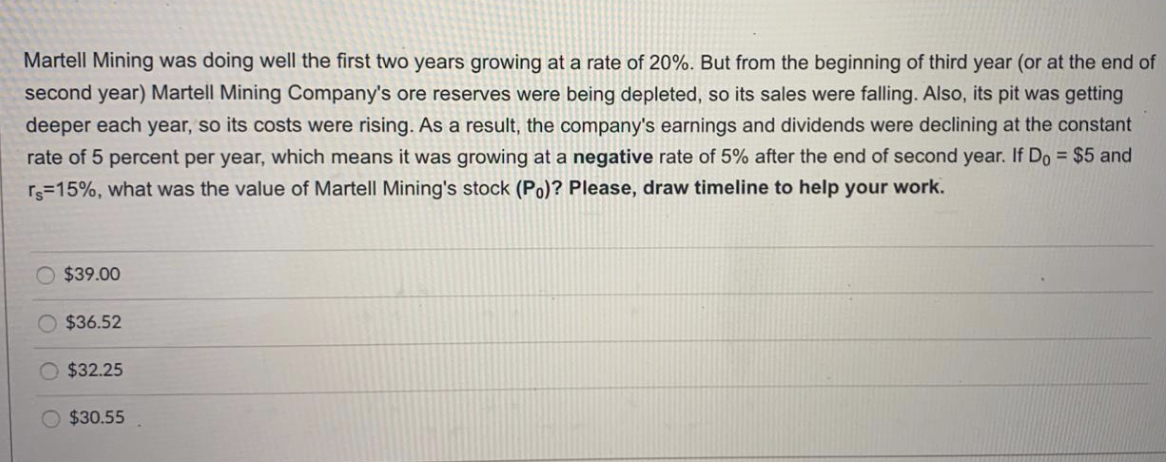

Martell Mining was doing well the first two years growing at a rate of 20%. But from the beginning of third year (or at the end of second year) Martell Mining Company's ore reserves were being depleted, so its sales were falling. Also, its pit was getting deeper each year, so its costs were rising. As a result, the company's earnings and dividends were declining at the constant rate of 5 percent per year, which means it was growing at a negative rate of 5% after the end of second year. If Do = $5 and ts=15%, what was the value of Martell Mining's stock (P.)? Please, draw timeline to help your work. O $39.00 $36.52 $32.25 $30.55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts