Question: Martha has estimated that she would need ( $ 35,000 ) per year (in today's ( $ ) terms) to live on in retirement. She

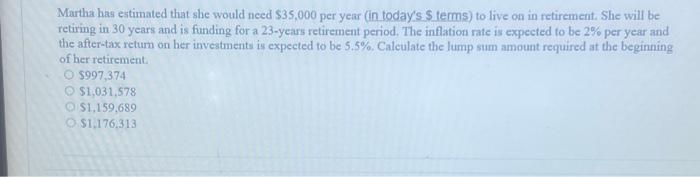

Martha has estimated that she would need \\( \\$ 35,000 \\) per year (in today's \\( \\$ \\) terms) to live on in retirement. She will be retiring in 30 years and is funding for a 23 -years retirement period. The inflation rate is expected to be \2 per year and the after-tax return on her investments is expected to be \5.5. Calculate the lump sum amount required at the beginning of her retirement. \\[ \\begin{array}{l} \\$ 997,374 \\\\ \\$ 1,031,578 \\\\ \\$ 1,159,689 \\\\ \\$ 1,176,313 \\end{array} \\]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock